Net Salary Calculator Switzerland

The salary dispersion interquartile range. If you then want to know exactly how much tax you have to pay on your profit not turnover based on the calculation you can actually use any income tax calculator.

Old-Age and Survivors Insurance OASI Disability Insurance DI and Income Loss Insurance.

Net salary calculator switzerland. Most people will come under rate A B or C. On the Federal Tax Administration website you can calculate the amount of income tax you will have to pay using the online tax calculator includes comparison between cantons. If you wish to enter you monthly salary weekly or hourly wage then select the Advanced option on the Switzerland tax calculator and change the Employment Income and Employment Expenses period.

Net salary calculator switzerland Postdoc and PhD salary in Switzerland. A quick and efficient way to calculate Switzerland income tax amounts and compare salaries in Switzerland review income tax deductions for income in Switzerland and estimate your tax returns for your Salary in Switzerland. For instance an increase of.

Hourly rates weekly pay and bonuses are also catered for. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. 30 8 260 - 25 56400.

The salary calculator helps you calculate your salary deductions and withholding tax. All bi-weekly semi-monthly monthly and quarterly figures. That means that your net pay will be CHF 41602 per year or CHF 3467 per month.

If you make CHF 50000 a year living in the region of Zurich Switzerland you will be taxed CHF 8399. The adjusted annual salary can be calculated as. However if you come to Switzerland as a foreigner to work your employer will probably have to deduct tax at source like PAYE.

Salary calculator for computing net monthly and annual salary. This is the amount of salary you are paid. Your average tax rate is 168 and your marginal tax rate is 269.

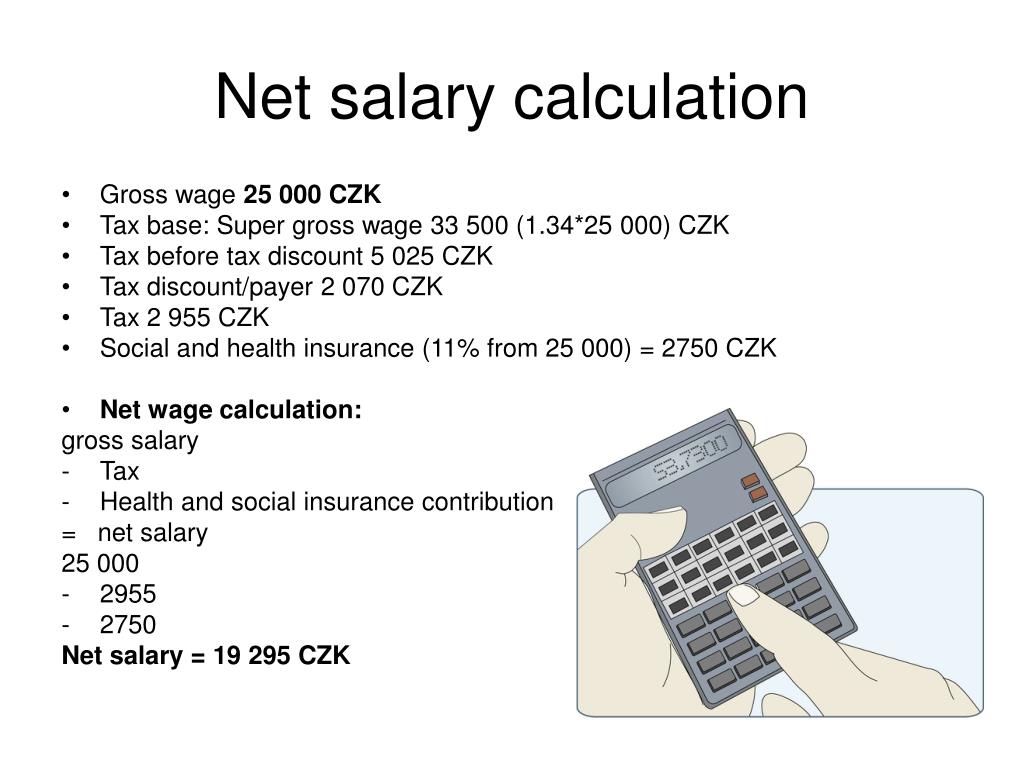

Calculate your take home pay in Switzerland thats your salary after tax with the Switzerland Salary Calculator. Gross salary is CHF 200000. With the calculator below you can calculate how much sourcetax you can expect to pay depending on your monthly gross salary.

We will give you an example. The latest budget information from April 2021 is used to show you exactly what you need to know. 1 of salary ceiling.

Just two simple steps to calculate your salary after tax in Switzerland with detailed income tax calculations. If youre married youll need to fill out a joint tax return and your calculation will be based on the combined income of. The gross monthly salary median value.

This hourly rate calculator only in German available is very helpful. In common with many countries Swiss tax returns are complex. Resident in the canton of Zurich city of Zurich no church taxes no asset taxes.

This marginal tax rate means that your immediate additional income will be taxed at this rate. With direct grossnet conversion. The Switzerland tax calculator assumes this is your annual salary before tax.

In analogy with many european countries stipend or scholarship holders instead of employment are exempted from. 505 of salary without a ceiling Unemployment Insurance UI. Income tax in Switzerland is levied by both the federal government and your canton.

The net salary and gross salary calculator on moneylandch makes it easy for you as an employee in Switzerland to find your net salary based on your gross salary and to find your gross salary based on your net salary. Postdoc and PhD students In Switzerland similar to Germany Denmark England and Sweden are mainly employed by the host institution through national or international funds or received scholarship. This means that your tax calculation in Switzerland is a combination of the rate set by the government and the rate in your local area.

What are the approximate costs of living expenses in Switzerland. The results do not represent wage recommendations. The wage calculator was developed in the context of the flanking measures to the free movement of persons between Switzerland and the European Union.

Why not find your dream salary too. The calculator accounts for Swiss OASIDIEO contributions unemployment insurance ALV contributions non-occupational accident insurance NOAI premiums paid sick leave insurance premiums and occupational pension fund contributions. Need more from the Switzerland Tax Calculator.

The salaries are calculated based on salary indications of thousands of registered users on jobsch and help you to better understand what you can earn in which region and in which sector. The average wages can be shown for the whole country by canton or by location. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year.

Swiss tax laws consider families to be one unit for tax purposes. The national wage calculator enables you to calculate a monthly gross wage central value or median and the spread of wages interquartile range for a specific individual profile. The statistical salary calculator Salarium is an interactive application which allows you to obtain for a specific job region economic branch occupational group etc and for a selection of individual characteristics age level of education years of service etc the following salary information.

What is left of the net income. Gross to net sample calculation rounded. The cross border rates are for.

Calculating obligatory insurances and taxes. Our database already includes the most important professions others are added constantly. Statutory assessment Gross annual incomes above CHF 120000 are subject to a retrospective tax assessment.

A direct overview of salaries and wages in Switzerland. One of a suite of free online calculators. Thanks to the salary calculator of jobsch you can compare the average salary for all common professions in Switzerland.

Photos Airbus A380 861 Aircraft Pictures Airliners Net Emirates Airbus Airbus Aircraft Pictures

Eseu Halloween Tăcere Net Salary Calculator Belgium2019 Justan Net

Payroll And Tax In Ireland Payroll Taxes Salary Calculator Tax Services

Taxes In France In 2021 All You Need To Know Moving To France

Salary In Switzerland Calculation Of The Net Salary From The Gross

Eseu Halloween Tăcere Net Salary Calculator Belgium2019 Justan Net

Base Salary Explained A Guide To Understand Your Pay Packet N26

Earnings Statistics Statistics Explained

Eseu Halloween Tăcere Net Salary Calculator Belgium2019 Justan Net

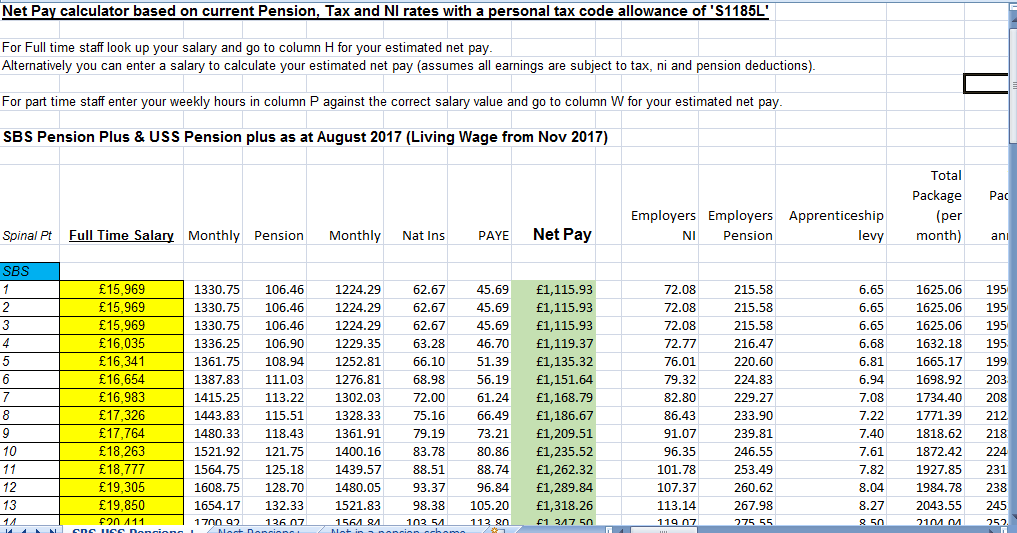

Salary After Tax Calculator For 2017

Calculating And Processing Net To Gross Salary In Swiss Sap Hr Payroll

Eseu Halloween Tăcere Net Salary Calculator Belgium2019 Justan Net

Base Salary Explained A Guide To Understand Your Pay Packet N26

Eseu Halloween Tăcere Net Salary Calculator Belgium2019 Justan Net

Salary In Switzerland Calculation Of The Net Salary From The Gross

Payroll Reconciliation Excel Template Inspirational 11 Payroll In Excel Format Free Business Template Example Payroll Template Statement Template Payroll

Wealth Tax Ifi Notaries Of France

The Art Of Wishfin And Why You May Need This Investing For Retirement Personal Loans Finance

Post a Comment for "Net Salary Calculator Switzerland"