Net Salary Calculator Nyc

Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more. Calculating Hourly Rate Using Annual Salary.

Click On Paycheckcity Com For Paycheck Calculators Withholding Calculators Tax Calculators Payroll Information And More For Payroll Paycheck Travel Nursing

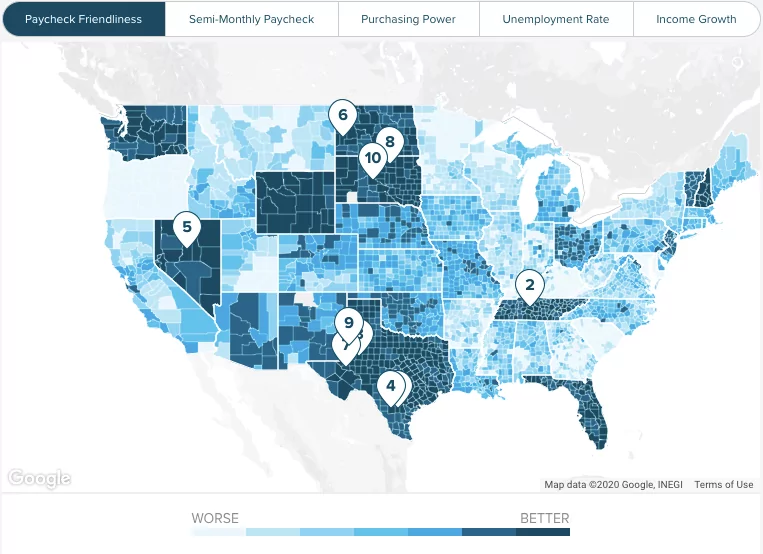

Overview of New York Taxes New York state has a progressive income tax system with rates ranging from 4 to 882 depending on taxpayers income level and filing status.

Net salary calculator nyc. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. If you make 55000 a year living in the region of New York USA you will be taxed 12213. ---Select Country--- Afghanistan Albania Algeria Angola AntiguaBarbuda Argentina Armenia Australia Austria Azerbaijan Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bhutan Bolivia Bosnia-Herz.

By and large you are being singled out for your excellent commitments and being given an incredible chance to propel your profession. Net Salary Calculator Nyc. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Annual Salary Bi-Weekly Gross 14 days X 365 days. This means that when calculating New York taxes you should first subtract that amount from your income unless you have itemized deductions of a greater amount. Employers in New Zealand usually deduct the relevant amount of tax from the salary through a pay-as-you-earn PAYE system.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be calculated as.

For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. Paycheck tax calculator nyc elim carpentersdaughter co. Calculate the salary that you will need in New York City based on the cost of living difference with your current city.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New York. For example if an employee. This places US on the 4th place out of 72 countries in the International Labour Organisation statistics for 2012.

Smartassets new york paycheck calculator shows your hourly and salary income after federal state and local. 30 8 260 62400. If your bi-weekly gross is 191781 your Annual Salary 191781 14 days X 365 days 50000.

To use our New York Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. You will get a 14-page downloadable report calculating the salary youll need. In New York the standard deduction for a single earner is 8000 16050 for joint filers.

For only 50 USD you will know the salary you need in New York City to maintain your current standard of living after you move. Try out the take-home calculator choose the 202122 tax year and see how it affects your take-home pay. Paid by the hour.

One of a suite of free online calculators provided by the team at iCalculator. The Debt Consolidation. After a few seconds you will be provided with a full breakdown of the tax you are paying.

In order to determine an accurate amount on how much tax you pay be sure to. That means that your net pay will be 40512 per year or 3376 per month. This places New Zealand on the 22nd place in the International Labour Organisation statistics for 2012.

The average monthly net salary in New Zealand NZ is around 3 117 NZD with a minimum income of 2 157 NZD per month. Your average tax rate is 222 and your marginal tax rate is 361. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US.

Use this New York gross pay calculator to gross up wages based on net pay. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Calculating Annual Salary Using Bi-Weekly Gross.

Calculate your New York net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New York paycheck calculator. This marginal tax rate means that your immediate additional income will be taxed at this rate. How to calculate net income.

Your average tax rate is 221 and your marginal tax rate is 349. That means that your net pay will be 42787 per year or 3566 per month. Taxes are deducted from the gross monthly salary and.

The New York Salary Calculator allows you to quickly calculate your salary after tax including New York State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting New York state tax tables. 14 days in a bi-weekly pay period. The result is net income How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2021. This marginal tax rate means that your immediate additional income will be taxed at this rate. 365 days in the year please use 366 for leap years Formula.

If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by consolidating them into one loan. It determines the amount of gross wages before taxes and deductions that are withheld given a specific take-home pay amount. The United States economy is the largest and one of the most open economies in the world representing approximately 22 of the gross world product.

New York Tax Credits. Can be used by salary earners self-employed or independent contractors.

How To Calculate Travel Nursing Net Pay Bluepipes Blog Travel Nursing Travel Nursing Pay Nurse

Pennsylvania Property Tax Calculator Smartasset Com Tax Refund Calculator Income Tax Property Tax

New Tax Law Take Home Pay Calculator For 75 000 Salary

If You Make 130 000 Year In Nyc What Is Your Take Home Bi Weekly Payment Quora

The Calculator Helps You Identify Your Tax Withholding To Make Sure You Have The Right Amount Of Tax Withheld From Your Payche Tax Irs Taxes Budgeting Finances

Net Worth Calculator How To Calculate Net Worth Net Worth Net Worth

How To Calculate The Net Salary From Gross In Portugal Lisbob Salary Portugal Calculator

New Tax Law Take Home Pay Calculator For 75 000 Salary

Don T Litter Nyc Advertisement Campaign Website Webdesign Design Campaign Nyc Web Design

New York Paycheck Calculator Smartasset

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Payroll Taxes

Paycheck Calculator Take Home Pay Calculator

How To Calculate Net Income Howstuffworks

Statement Of Retained Earnings Reveals Distribution Of Earnings Earnings Investing Preferred Stock

How Much Is My Apartment Worth Nyc Hauseit Nyc Apartment Worth

New York Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

Post a Comment for "Net Salary Calculator Nyc"