Gross Monthly Income On Paystub

This number represents the employees taxable income for the pay period. I tried finding an itemized line item on the paycheck that could explain this.

Reading Paystubs Where S The Magi Ripin

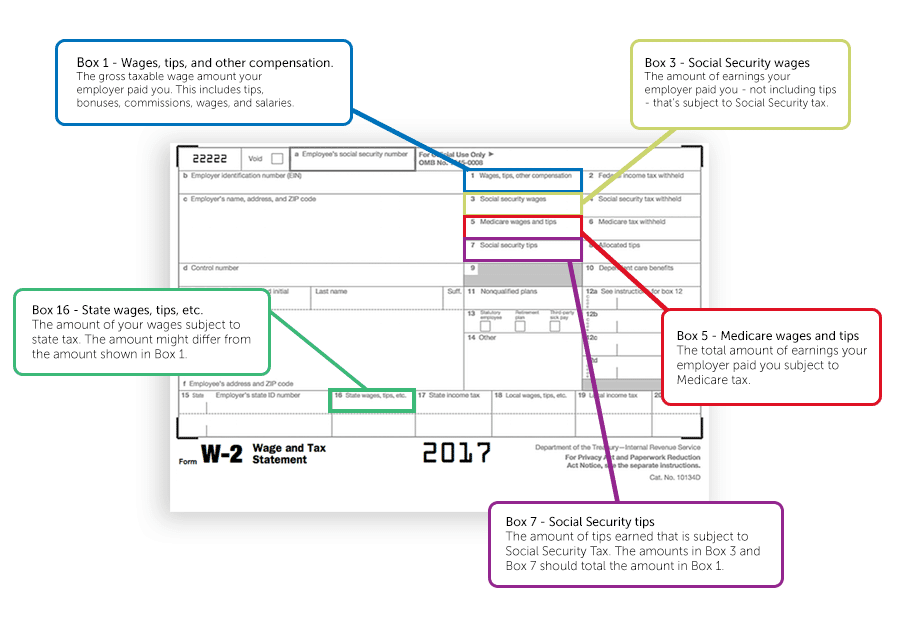

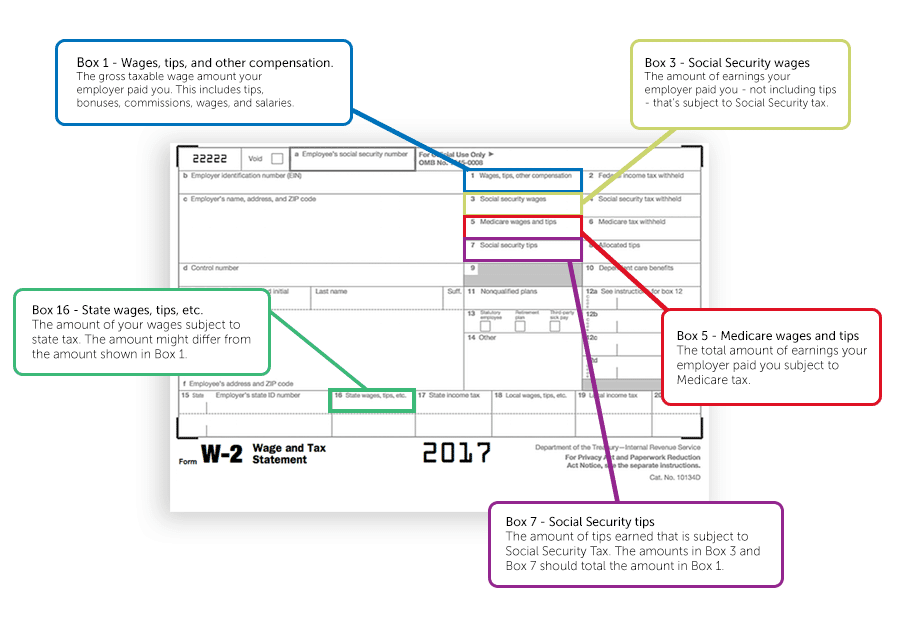

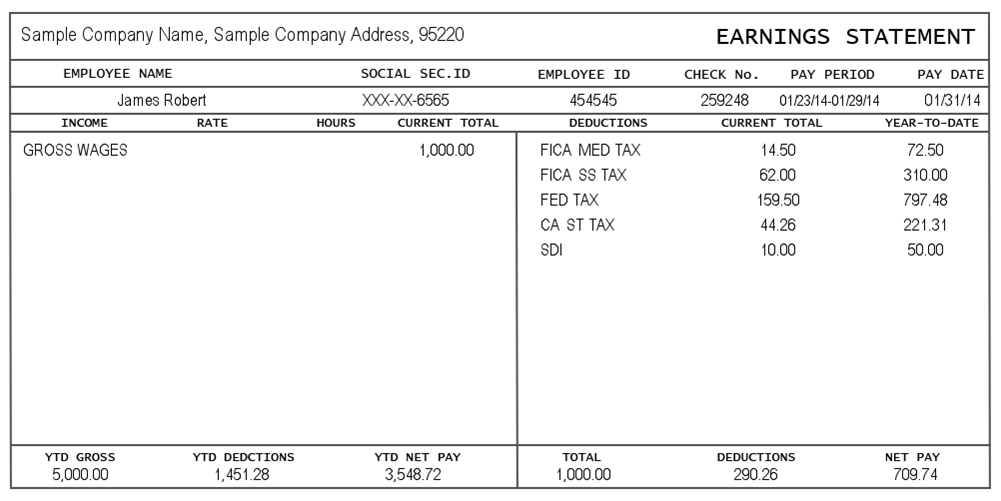

Be sure to check that the information on your last pay stub of the year matches the information on your W-2 form which details your wages and taxes paid for the year.

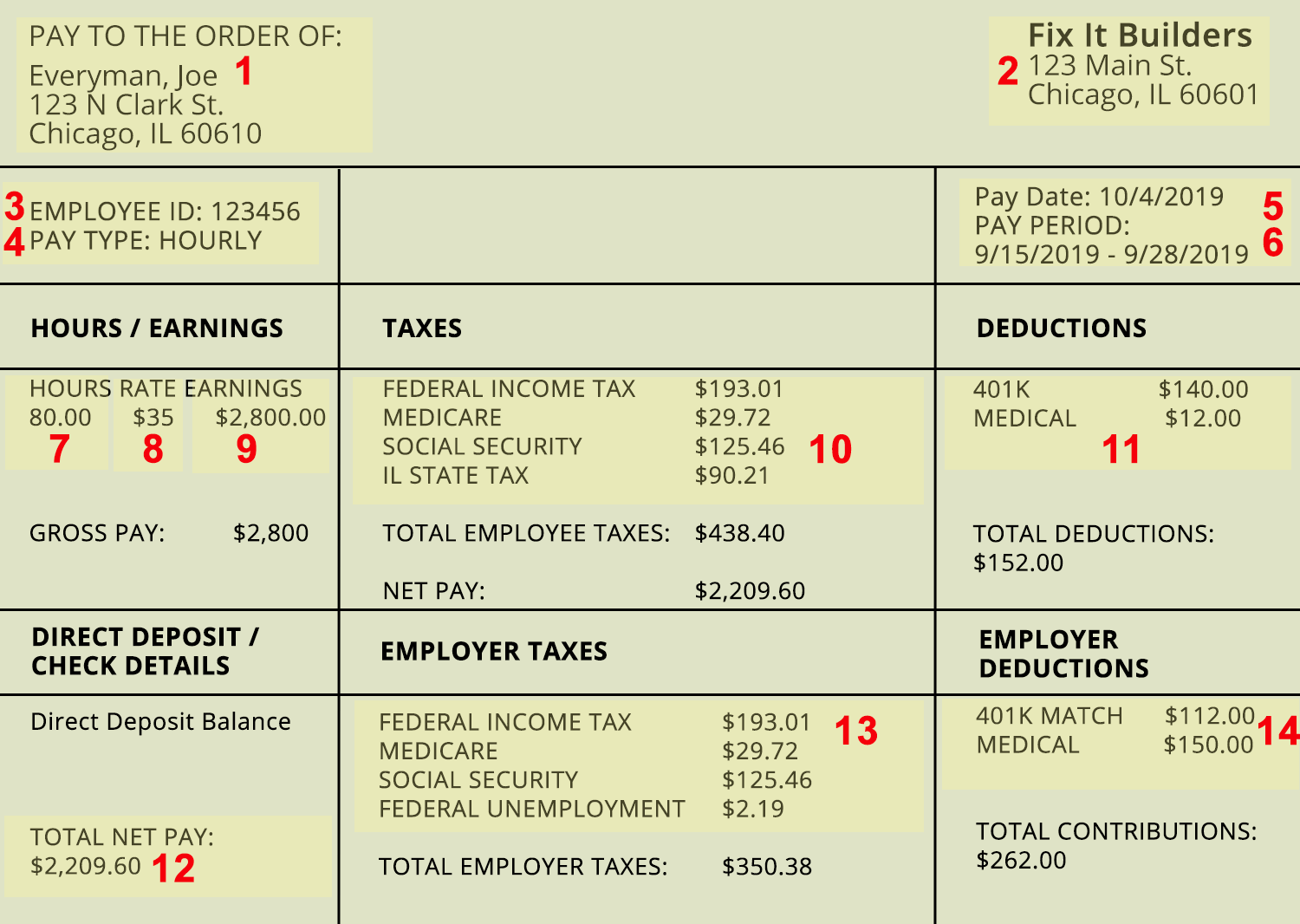

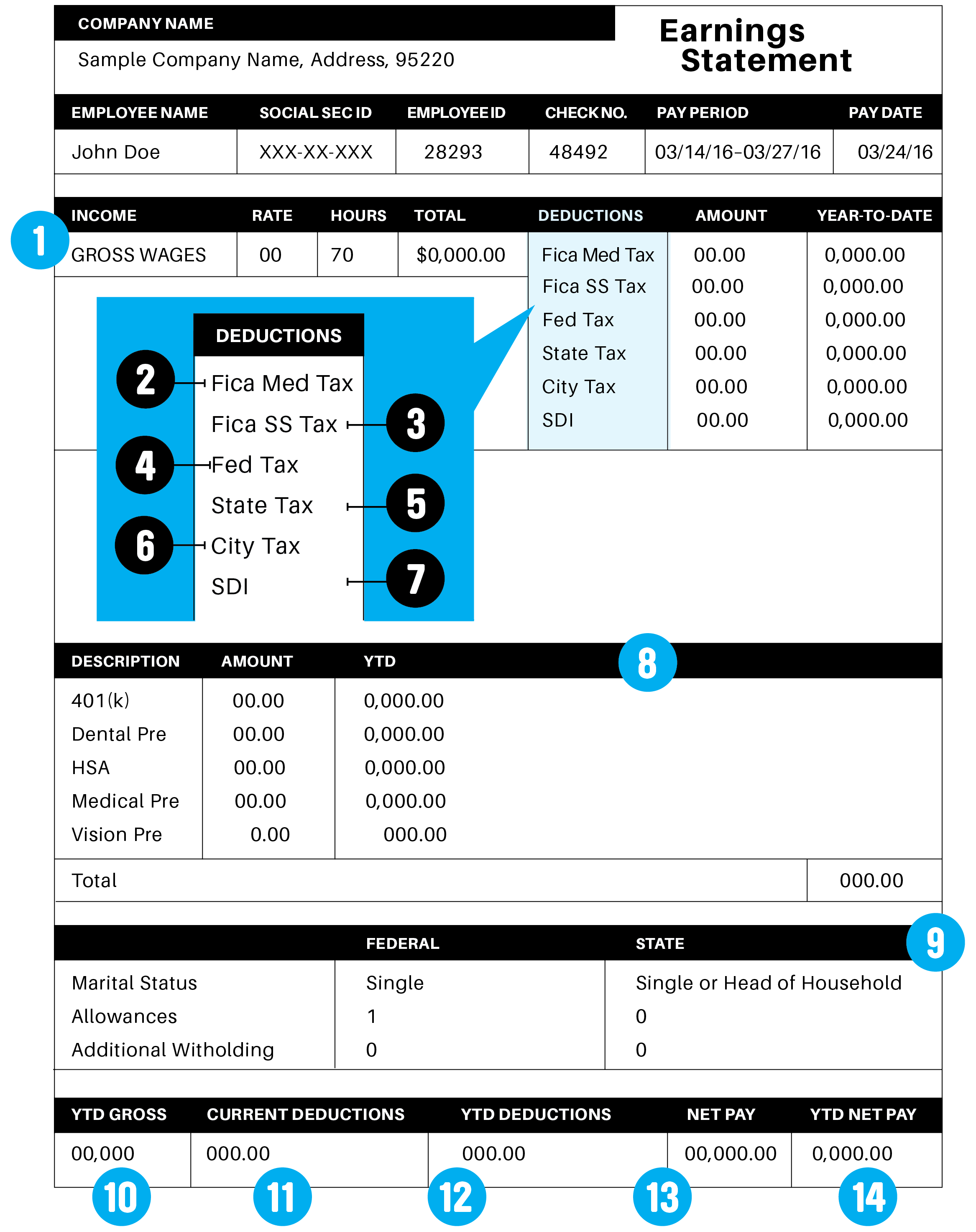

Gross monthly income on paystub. This is the total amount of money youve earned without deductions or tax withholdings. If you are paid hourly multiply your hourly wage by the number of hours you work per week. Then take their annual income based on their contract and divide it by the number of pay periods for one year.

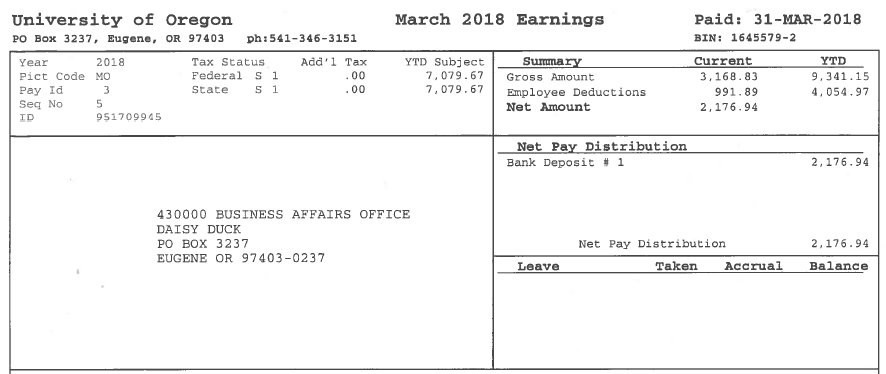

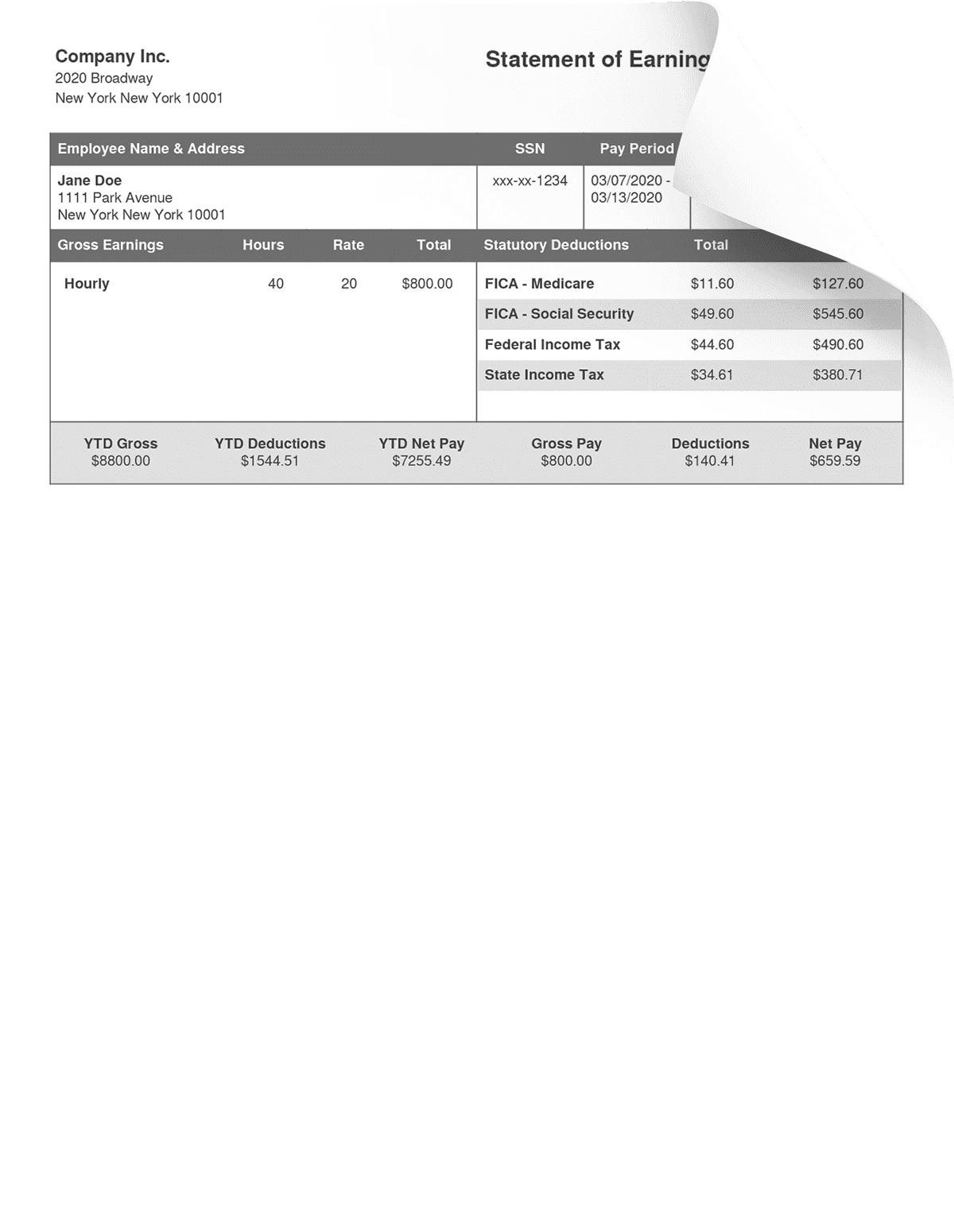

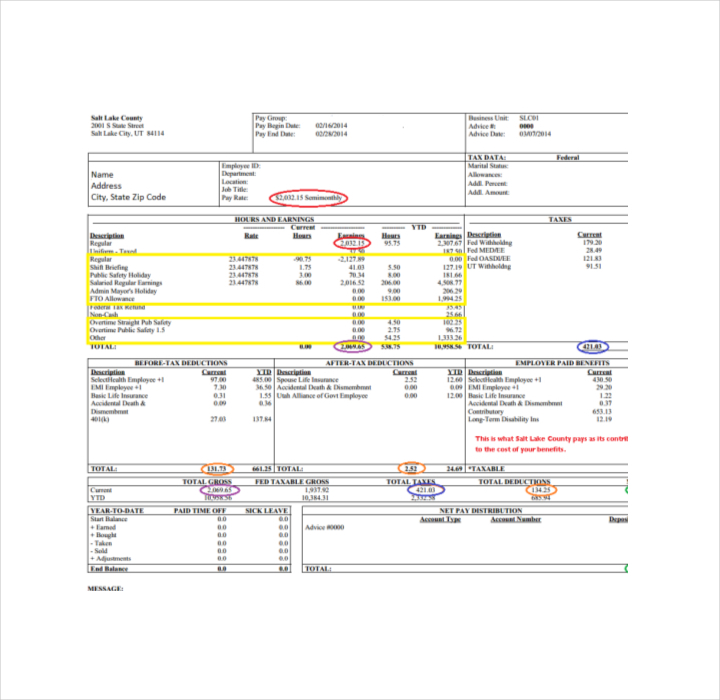

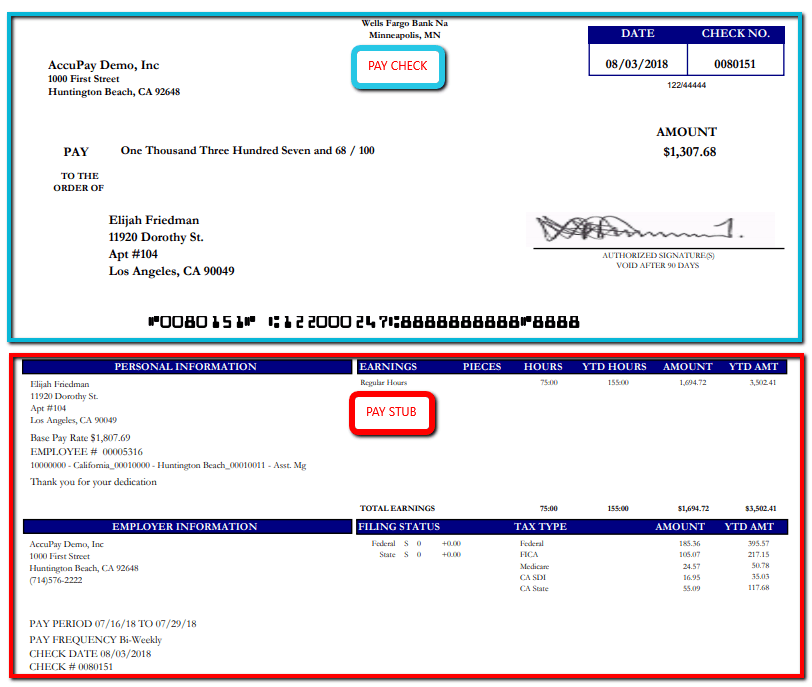

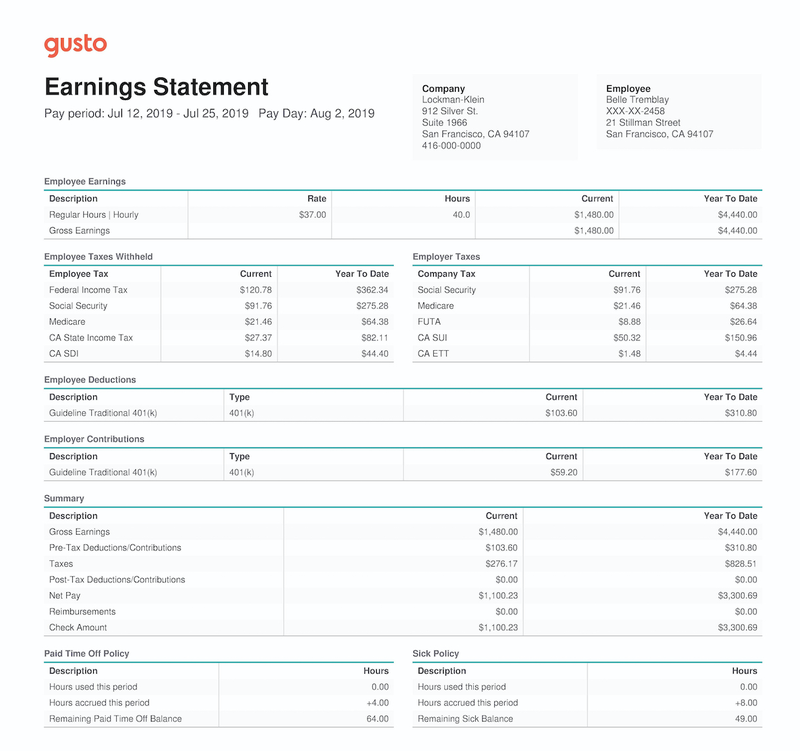

A typical paystub shows the information of gross pay in 2 separate fields which are current gross pay and year-to-date gross one. Pay Stub Deduction Codes. The total amount of pay before any deductions are taken out Return to footnote 2 Referrer.

For example Jane makes 120000 per year and paid bi-weekly. Net income on the other hand is what you actually receive after your employer deducts federal and state income taxes and other expenses such as health insurance premiums. 205 Hartsdale NY 10530.

Return to footnote 1 Referrer. We have a safe and secure website with built in calculators that can figure all the numbers out for you right down to the penny. February 27 2021 Leave a comment.

The quickest explanation for this difference is that the last pay stub and W-2 form will almost always show two different wages. Input this income figure into the calculator and select weekly for how often you are paid. The truth is that unless there have been no deductions taken from a paycheck an employees last pay stub and W-2 form will almost never match.

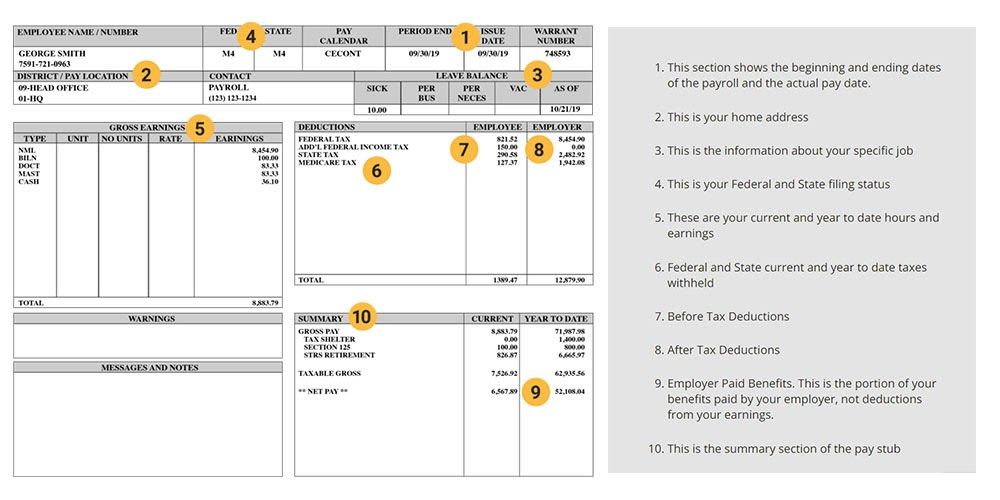

The gross pay of a paystub can also have other information such as. The columns labeled Current and YTD help the employee track how much theyve earned and paid in taxes and deductions for the pay period and for the entire year through the respective pay period. For example if the employees gross pay is 50000 for a year with a monthly pay schedule then 5000012 is the gross wage for every pay period.

The first step of calculating your W2 wages from a paystub is finding your gross income. Gross pay Gross pay refers to the total sum of money earned in a pay period before taxes or deductions are withheld. You can determine your average gross monthly income using the Year-to-Date figure on your pay stub.

Locate the year-to-date section on your pay stub. Your gross income stated in Box 1 of your W-2 is essential in filing your taxes as it shows your wages subject to federal income tax. Knowing your gross income not only helps you get a sense of how much your total salary.

End of the year check stubs will show the total or gross earnings that an employee received whereas a W-2. To use the PAYE calculator enter your annual salary or the one you would like in the Insert Income box below. The total amount of pay and deductions from the beginning of the year through the current pay period.

This allows you to accurately and confidently plan your monthly and yearly budgets. Gross income is the total money you are paid before deductions. Find us on Map.

If you only want to figure the total amount your employer paid you for the year your last pay stub of the year should show all of the earnings you received. When talking about monthly income people use two major categories. If you do not have one ask your employer for the information.

Boxes 3 and 5 of the W-2 show your gross income that is subject to Social Security and Medicare taxes. A pay stub also lists gross and net income to-date. How to find gross income on paystub.

Select how often you are paid and input how much money you earn per pay period and the calculator shows you your monthly gross income. Her gross earnings on paystub would turn out in a 5000 gross pay for each pay period. How to Calculate the Gross Monthly Income Based on the Gross Year to Date Step 1.

A percentage of gross income paid by employees and employers to provide temporary payments if workers become unemployed. Get your most recent pay stub. Firstly identify the pay period for that employee whether weekly bi-weekly or monthly.

However the W2 Gross that shows on Quickens paycheck which is factoring in all deductions and taxes I paid is off by about 30 dollars vs what my paystub shows as Fed Taxable Gross. 141 South Central Park Ave. I am using the Q Paycheck feature and have all info inputted correctly and the net income matches what I was paid so thats good.

Gross pay on a pay stub is the total wages an employee usually earns before payroll taxes and other deductions are taken out. For 1040 form 2009 year this should be line 37 on your tax return otherwise known as. This is usually at the bottom or in a column on the far-right.

You can use our Monthly Gross Income calculator to determine your gross income based on how frequently you are paid and the amount of income you make per pay period. This means you know exactly how much money you are taking home. For many people this will be an hourly rate multiplied by a certain number.

To calculate the gross pay for salaried workers you will divide the annual salary by the number of pay periods in that year. Call To Reserve Your Course. A percentage of gross income paid by employees and employers to provide temporary.

Use this calculator to estimate the monthly and annual.

Understanding Your Paycheck Credit Com

What Does A Pay Stub Look Like Workest

How To Read Your Earning Statement Business Affairs

Reading Paystubs Where S The Magi Ripin

3 Ways To Read A Pay Check Stub Wikihow

Reading Paystubs Where S The Magi Ripin

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

How To Read A Pay Stub Opploans

Create Pay Stubs Instantly Generate Check Stubs Form Pros

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Does Pay Stub Pay Check Stub Salary Slip Or Payslip Mean

Pay Stub Generator Free Printable Pay Stub Template Formswift

What Everything On Your Pay Stub Means Money

Hrpaych Yeartodate Payroll Services Washington State University

9 Free Pay Stub Templates Free Pdf Doc Format Download Free Premium Templates

A Guide On How To Read Your Pay Stub Accupay Systems

Gross Wages What Is It And How Do You Calculate It The Blueprint

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Post a Comment for "Gross Monthly Income On Paystub"