Salary Sacrifice Journal

It doesnt appear to be. Heres how you can handle this salary sacrifice arrangement in AccountRight.

![]()

How To Correctly Post Your Salary Journal

The employee portion will be deducted from salary and paid to ESI Corporation including employer contribution.

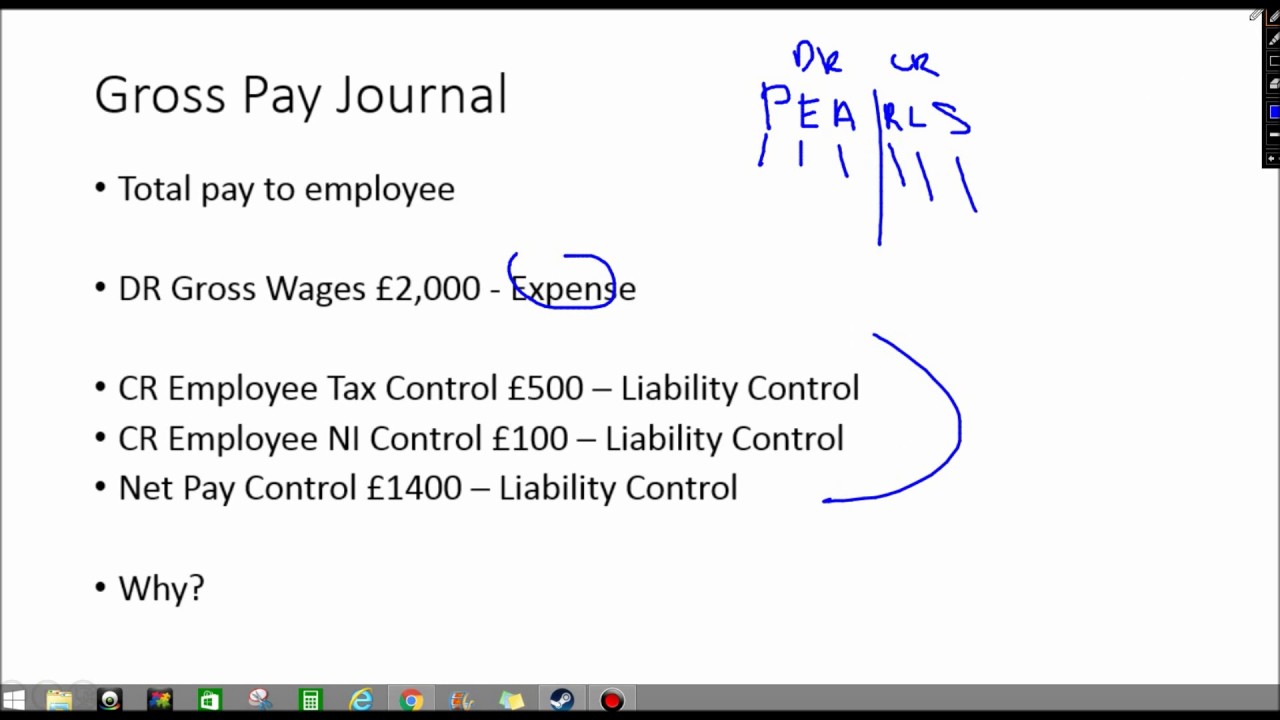

Salary sacrifice journal. A salary sacrifice would involve the gross salary being lower the employee has sacrificed some salary and the employers contribution being higher by the same amount. The Gross Wagess is the expense. If you want these expenses kept separate from wages and salaries youll need to keep using manual journals to re-allocate the expense where you want it.

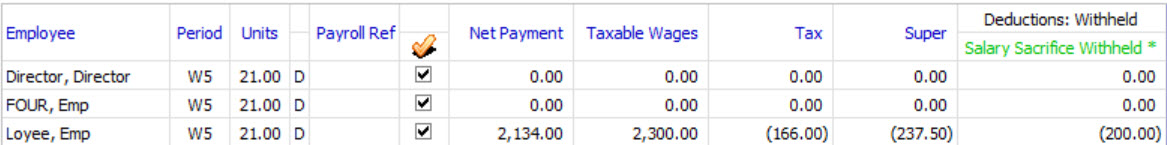

Its a tax-efficient way to make extra contributions to your pension and both you and your employer will pay lower National Insurance Contributions on your reduced salary. The salary sacrifice is taken from their gross salary before tax which means that the employee will pay less Income Tax and National Insurance NI and that the employer will reduce their. SGC super is calculated on the Pre salary sacrifice Taxable wages.

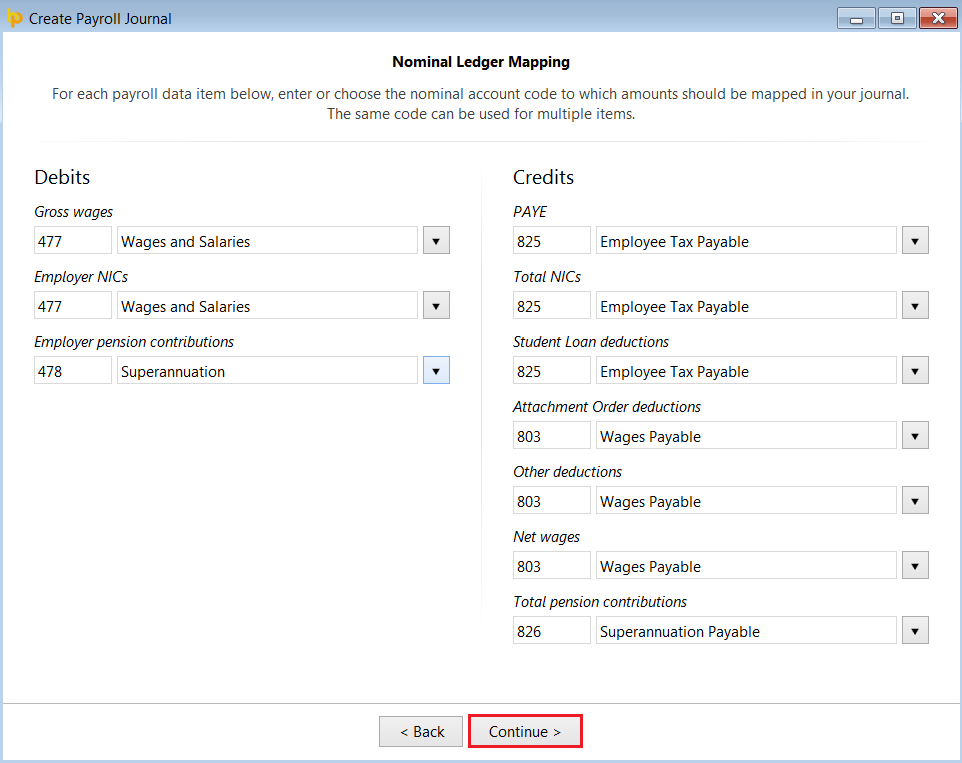

Once the salary sacrifice is in place the amounts to be reflected in the accounts are the salary of Y the costs of providing the. The following table shows an example of a salary journal with a salary sacrifice. We recommend that you complete your salary journals at the end of each pay period.

Pension contributions and employer-provided pensions advice. Where super salary sacrifice is involved the expense is included as part of wages and salaries. Certain benefits provided by an employer under an ESSA are subject to fringe benefit tax.

Before services are performed that will result in the payment of the employees salary etc. Salary sacrifice schemes that are excluded exemptions that continue to offer a tax and national insurance benefit mean that employers also do not need to value the benefit item nor report to HMRC for a salary sacrifice arrangement. The employees contribution appears to be exactly that - the employees contribution.

A change was introduced on 1 January 2020. You can find more on this here. This includes the wage payments actually made to your employees the amount you have paid to HMRC for tax etc as well as keeping track of employee costs.

Before Salary Sacrifice is entered. Salary sacrifice is an arrangement where an employee agrees to forego part of their future salary or wages in return for their employer providing benefits of a similar value. When there is a Salary Sacrifice agreement the SGC is often calculated based on the reduced salary however it will depend on the actual agreement entered with your employee.

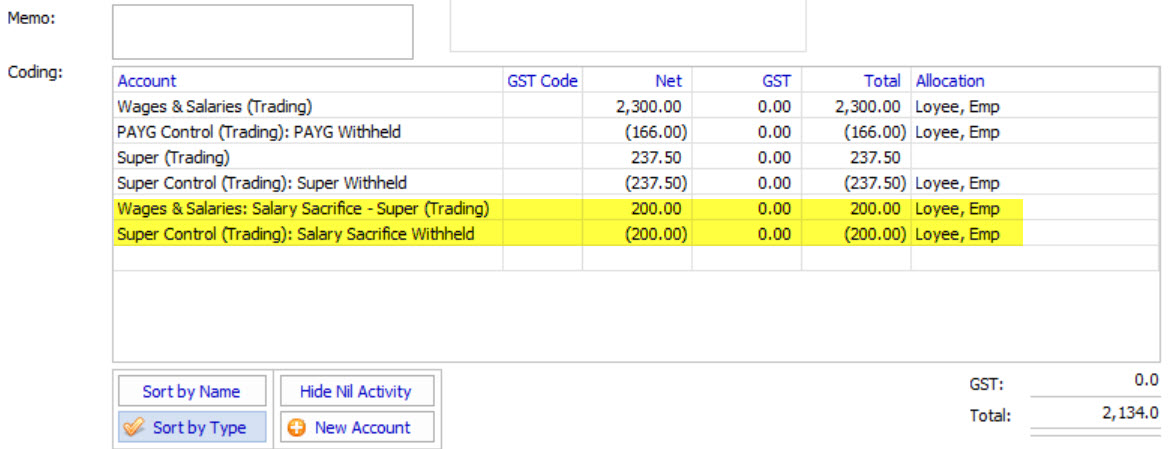

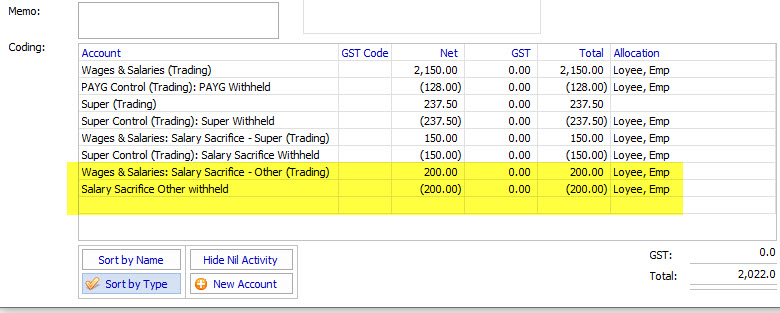

This means that the employee agrees to give up part of their salary in exchange for a benefit in this instance the benefit is a bike andor accessories. In the simplest terms possible salary sacrifice is an agreement between an employee and employer where the employee agrees to receive less before-tax income. Below is an example of the payment coding.

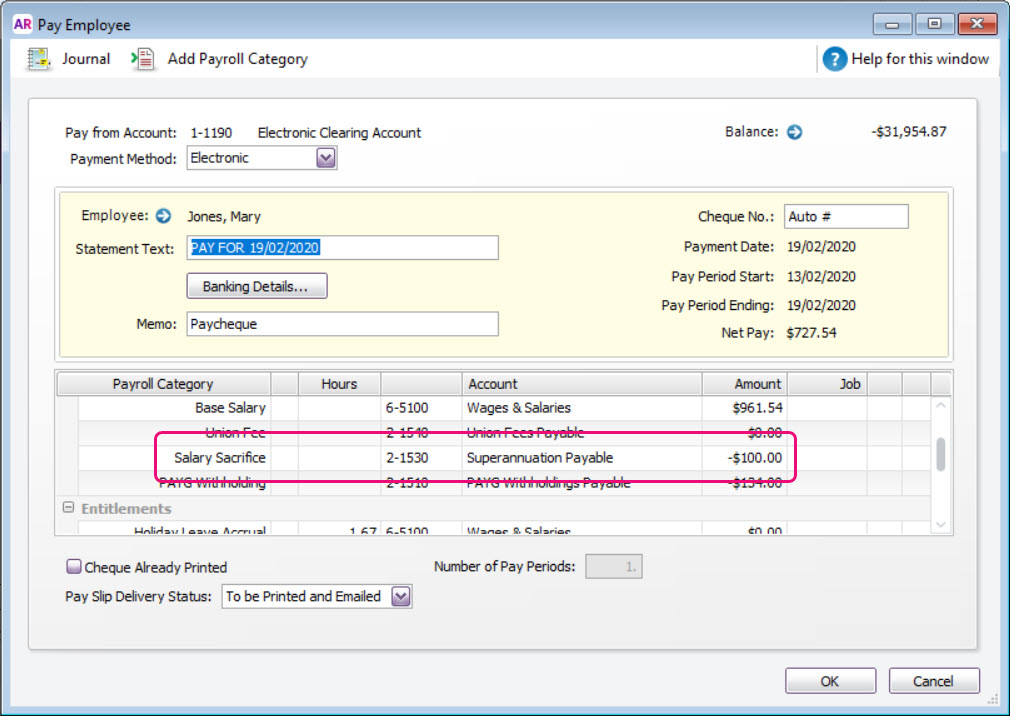

Other Salary Sacrifice schemes including Salary Sacrifice Pensions follow the same principles. Allocate the purchase of the item being sacrificed to a Salary Sacrifice liability account. 1-1220 Electronic Clearing Account 0 CR 6-1400 Wages Expenses X DR 2-1420 Superannuation payable X CR.

By default Salary Sacrifice will be tracked by the Wages Salaries expense account and the Payroll Deductions liabilities account. It is applicable for all employees whose salary is Rs15000- per month. The employer contributes 475 percent and employee contributes 175 percent total of 65 percent.

If you need to make journal entries its indicative of there not being a valid salary sacrifice. For example the growth of salary sacrifice after 2005 was for the. Unlike SGC its not always considered an additional expense to the employer.

The way a salary sacrifice works is that the employee who was on a salary of X now agrees to be remunerated by way of a salary of Y and stated benefits going forward. You will notice the reduction in Taxable Wages and Tax as well as an additional accrual journal for salary sacrifice. What is a salary sacrifice pension.

Salary sacrifice allows you to give up some of your salary so you can claim extra benefits from your employer. These excluded exemptions are. What can I salary sacrifice.

Cycle to work operates as a salary sacrifice employee benefit. It therefore follows that for that to happen the benefit that is provided must be subject to tax or Ni relief or both. Salary journals are where you record all the information used to pay your employees.

The journal entry below recorded in MYOB is correct. The amount offsets the payable liability account. Set up a salary sacrifice deduction and link it to this account.

What makes you say this is a salary sacrifice pension. The sacrifice if shown on the payslip and most employers wish to do this must be shown on the additions side of the payslip as a negative adjustment. An employee can sacrifice their salary or wages into a variety of benefits including superannuation.

A successful sacrifice s trying to achieve some tax and NI savings. What is salary sacrifice. To be an effective salary sacrifice arrangement ESSA the arrangement must be entered into before the employee becomes entitled to the income eg.

After the salary sacrifice has been entered. Record the employees pay with the salary sacrifice amount deducted from their pay. The Salary Sacrifice is not an expense to your business.

The maximum amount that any employee can sacrifice is 243 per month or 55 per week. In return for their sacrifice the employer agrees to provide them with benefits of comparable value. It has even been deducted net of tax.

Basically youre using some pre-tax salary and using it to buy something youd typically pay for with your after-tax income. Salary sacrifice is often used in connection with pension arrangements because it can result in higher take-home pay due to savings in national insurance wi.

Integra Financial System General Ledger Journal Entry Manual

How To Enter Wages Entries Having A Salary Sacrifice Component Exalt

How To Enter Wages Entries Having A Salary Sacrifice Component Exalt

Pdf The Impact Of Pay Understanding On Pay Satisfaction And Retention Salary Sacrifice Understanding In The Not For Profit Sector

Format Of Journal Entry Exampale Journal Entry Journal Journal Entries

Trial Balance Accounting Meaning Definition Method Features Advantages Limitation Trial Balance Accounting Financial Statements

Pdf The Impact Of Pay Understanding On Pay Satisfaction And Retention Salary Sacrifice Understanding In The Not For Profit Sector

Xero Csv Upload Brightpay Documentation

Set Up Salary Sacrifice Superannuation Myob Accountright Myob Help Centre

Page Ramadan Bullet Journal Dessin Journal Ramadan Bullet Journal

Journal Entry In Accounting Journal Entry Accounting Journal

How To Enter Wages Entries Having A Salary Sacrifice Component Exalt

General Journal Or Journal Proper In Accounting Journal Learning Objectives Accounting Process

Don T Sacrifice Your Peace Trying To Point Out Someone S True Colors Lack Of Character Alwa Someones True Colors Playing The Victim Quotes True Colors Quotes

How To Enter Wages Entries Having A Salary Sacrifice Component Exalt

Exponential Growth Devours And Corrupts Signal V Noise Coaching Leaders Exponential Growth Exponential Growth

Wages Journal Basics How To Payroll Accounting Youtube

Post a Comment for "Salary Sacrifice Journal"