Hourly Wage Calculator California

Weekly paycheck to hourly rate. How do you calculate.

Paycheck Calculator Take Home Pay Calculator

Annual salary to hourly wage 50000 per year 52 weeks 40 hours per week 2404 per hour.

Hourly wage calculator california. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. That means that your net pay will be 42930 per year or 3577 per month. Also you may want to see if you have one of the 50 best jobs in America.

Hourly wage calculator convert yearly salary to hourly How much is your yearly salary per hour. How many hours do you work per day WPD. What is the hourly rate for 28000 pounds a year.

1500 per week 40 hours per week 3750 per hour. The assumption is the sole provider is working full-time 2080 hours per year. The tool provides information for individuals and households with one or two working adults and zero to three children.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in California. In the case of households. If you make 55000 a year living in the region of California USA you will be taxed 12070.

Enter Hours Worked hint - enter decimal85 or hhmm830 formats. Working hour per week. Enter your salary or wages then choose the frequency at which you are paid.

Enter your info to see your take home pay. Under California meal break law which is much more generous to employees than federal labor law if you are a non-exempt worker you are entitled to a 30-minute uninterrupted duty-free meal break if you work more than 5 hours in a workday. It should not be relied on as legal advice.

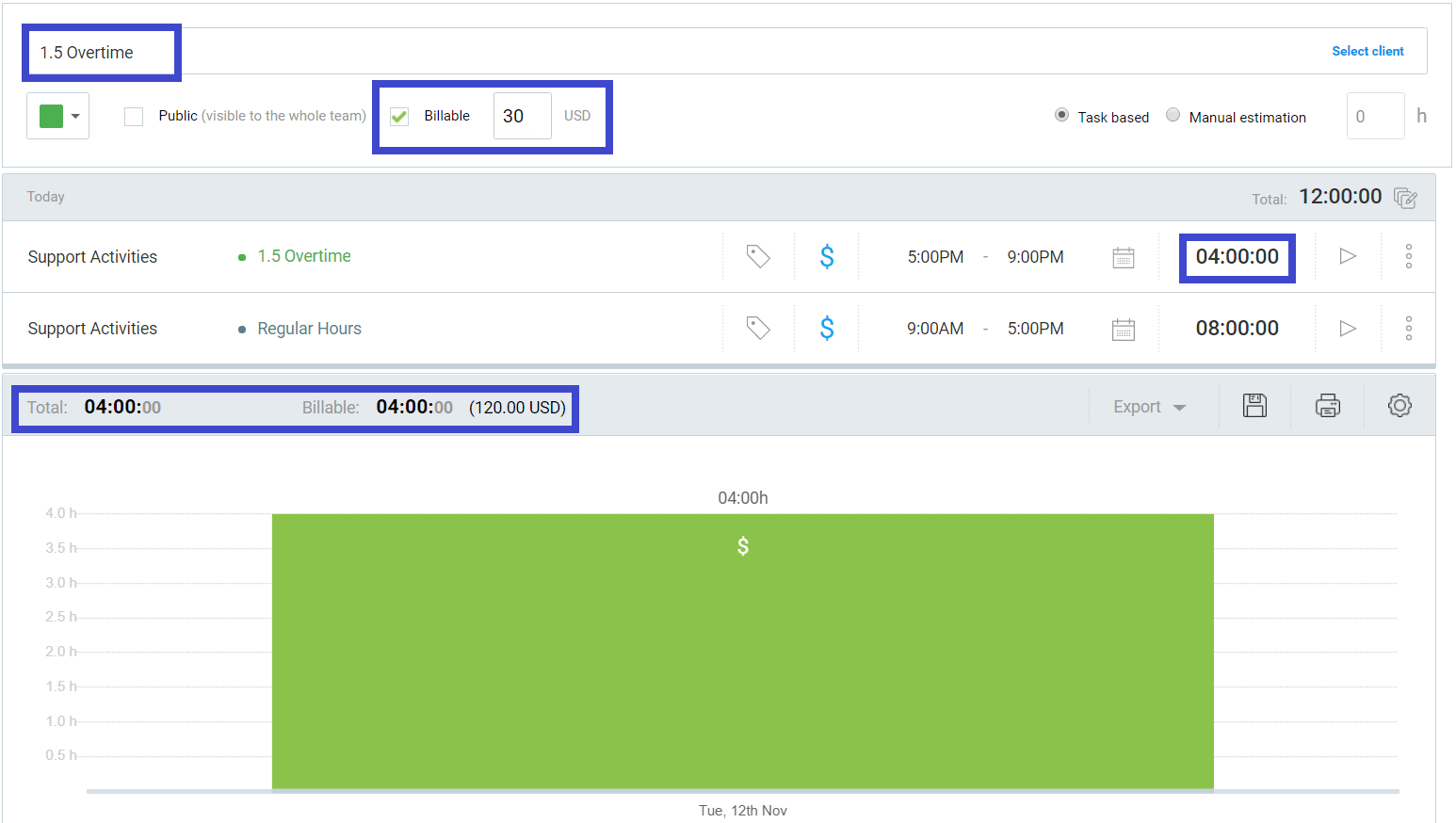

Living Wage Calculation for California. This easy and convenient tool will help employers and employees within the state of California to accurately calculate overtime hours worked. 1077 per 2 weeks.

So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the California Salary Calculator uses California as default selecting an alternate state will use the tax tables from that state. 3000 dollars hourly including un-paid time is 6240000 dollars yearly including un-paid time. You are also entitled to a 10-minute uninterrupted duty-free rest breaks for every 4 hours you work or major fraction thereof.

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Please note that this calculator does not cover any exceptional circumstances like how to calculate overtime for employees subject to an alternative workweek schedule. Thats because your employer withholds taxes from each paycheck lowering your overall pay.

Second calculation approach is within 2 nd tab and uses the following figures that should be given. Monthly wage to hourly wage 5000 per month 12 52 weeks 40 hours per week 2885. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Enter your hourly wage and hours worked per week to see your monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. The assumption is the sole provider is working full-time 2080 hours per year.

28000 pounds per year is about 15 pounds an hour. The calculator below can be used as a rough guide to determine how much overtime to which a California employee might be entitled2. If your boss doesnt comply with break.

In the case of households. Your average tax rate is 220 and your marginal tax rate is 397. Their primary work more than 50 should be focused on executive administrative or professional duties.

Must be paid a salary equivalent to at least double the amount paid to a full-time employee making minimum wage in California 54080 based on the 2020 minimum wage of 13hour. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Because of the numerous.

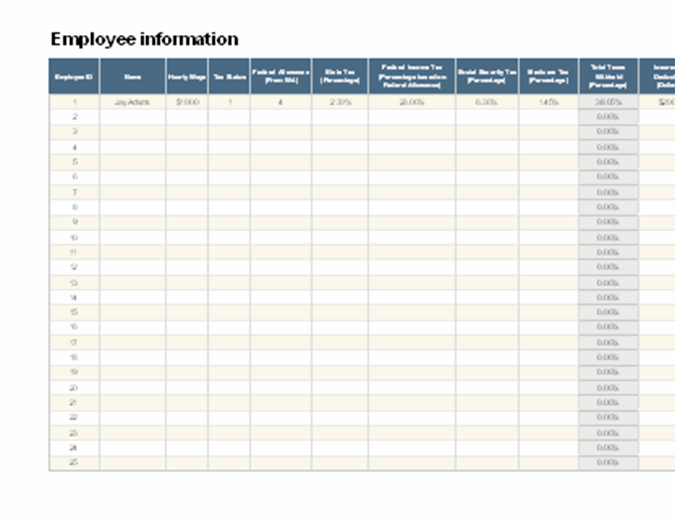

How much do you get paid GP. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. 120 per day 8 hours 15 per hour.

This information may help you analyze your financial needs. You may also want to convert an hourly wage to a salary. Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator.

This California hourly paycheck calculator is perfect for those who are paid on an hourly basis. Living Wage Calculation for San Francisco County California. The tool provides information for individuals and households with one or two working adults and zero to three children.

- hourly wage HW. How many days per week do you work WDW. SmartAssets California paycheck calculator shows your hourly and salary income after federal state and local taxes.

Daily wage to hourly rate. The latest budget information from April 2021 is used to show you exactly what you need to know. Use this calculator to determine what your hourly wage equates to when given your annual salary - it may surprise you what you make on an hourly basis.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. You will make about. A Hourly wage B WPD B Daily wage C WDW C Weekly wage E 52 D Monthly wage GP 12 E Annual wage GP.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Payroll Taxes

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Paycheck Calculator Take Home Pay Calculator

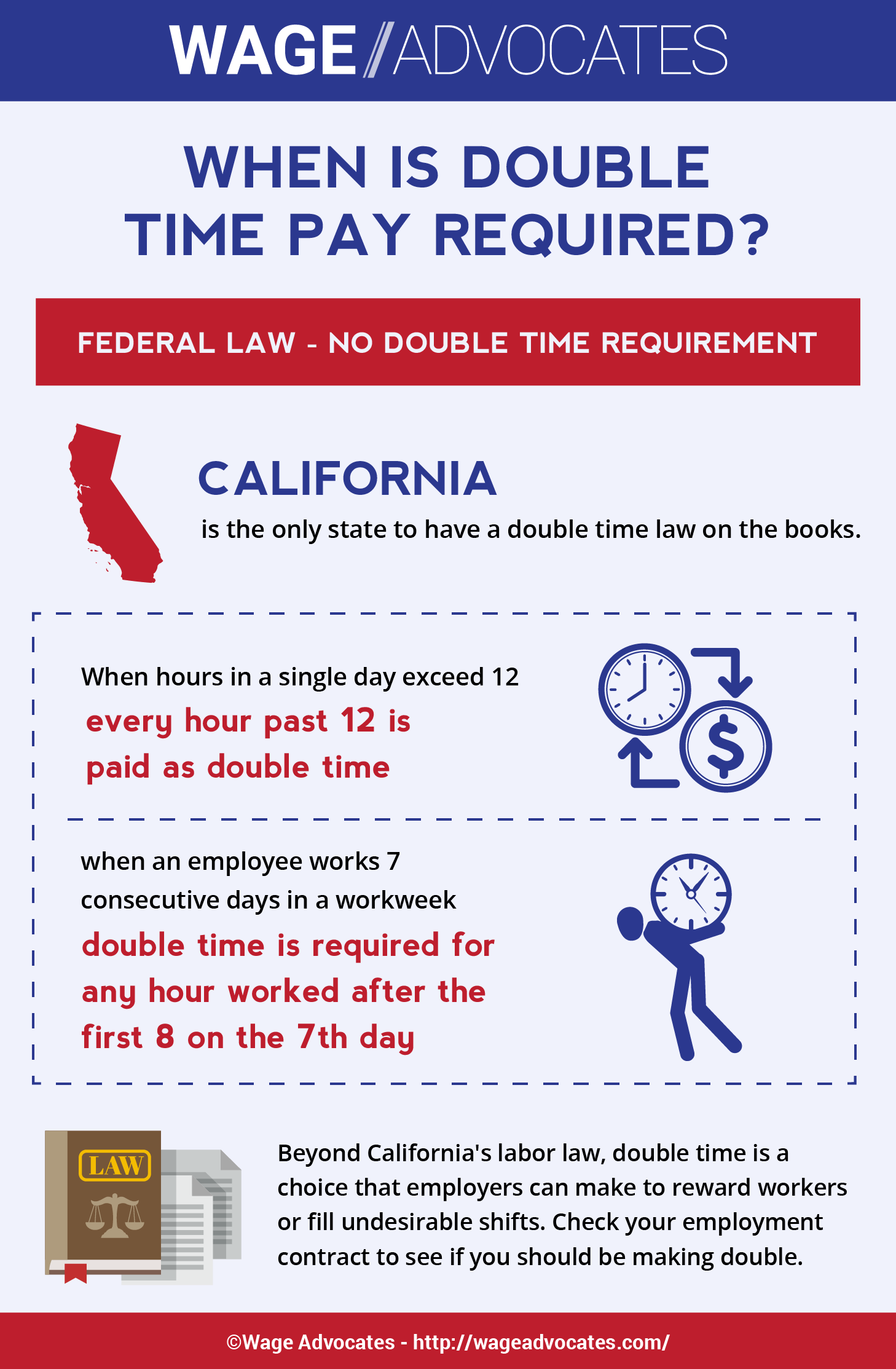

What Is Double Time Pay When Is It Mandatory Overtime Lawsuit

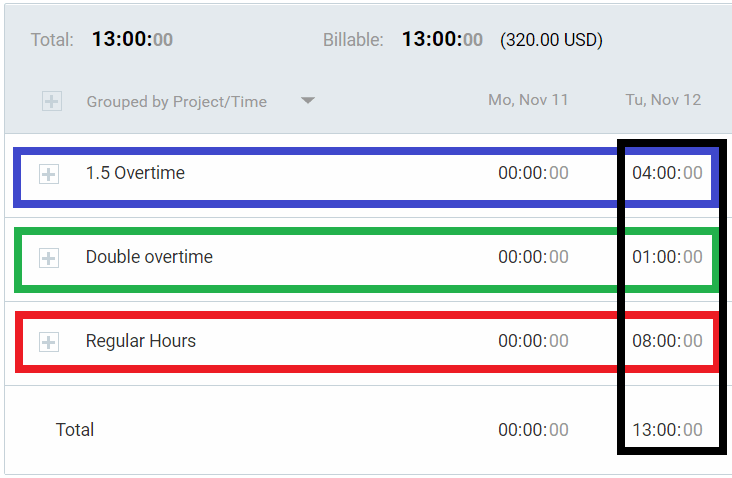

California Overtime Law 2021 Clockify

Average Salary In California 2021 The Complete Guide

How To Calculate Process Retroactive Pay

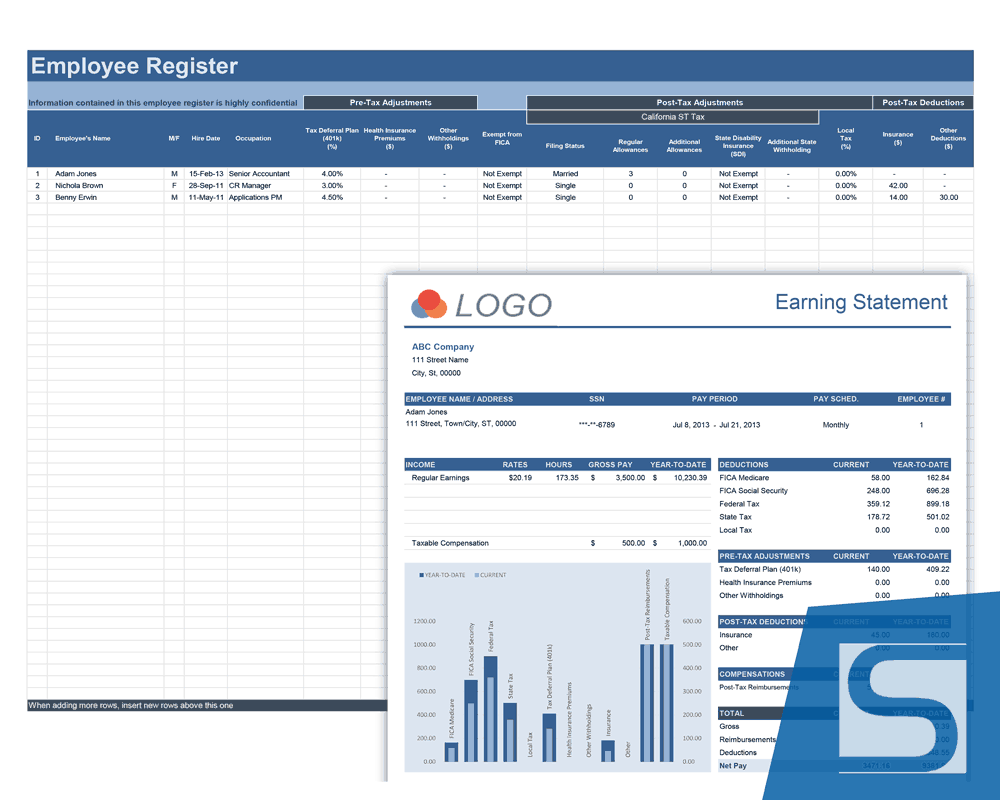

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

California Overtime Law 2021 Clockify

Top 7 Free Payroll Calculators Timecamp

Ca Income Tax Calculator July 2021 Incomeaftertax Com

California Wage Calculator Minimum Wage Org

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

California Overtime Law 2021 Clockify

Post a Comment for "Hourly Wage Calculator California"