Salary Sacrifice Vs Auto Enrolment

Deducted before tax and National Insurance contribution. The pension is fixed through the UK and enforced by the Pension.

Salary Sacrifice Nest Pensions

There are two ways in which you can do this simple salary sacrifice and SMART Save more and reduce tax.

Salary sacrifice vs auto enrolment. These employees are automatically placed into the scheme with an option to opt-out. Making salary sacrifice the sole mechanism to achieve auto enrolment will be deemed a restriction. Lower life cover this is because employers generally work out the entitlement as a multiple of salary and salary sacrifice makes that salary.

Under this tax basis youd deduct employee contributions from their pay after tax is taken. When you give up part of your wages through a salary sacrifice scheme youll pay less tax and national insurance on your gross earnings. Salary Sacrifice for Auto Enrolment.

Salary sacrifice on the other-hand is a voluntary reduction to the employees contractual pay. It is the law that every employer auto-enrols their employees into a workplace pension scheme provided that those employees are between the ages of 22 and state pension age and earn a minimum of 10000 annually. HMRC has made it clear that an employer must document and agree a salary sacrifice arrangement with each employee before it takes place.

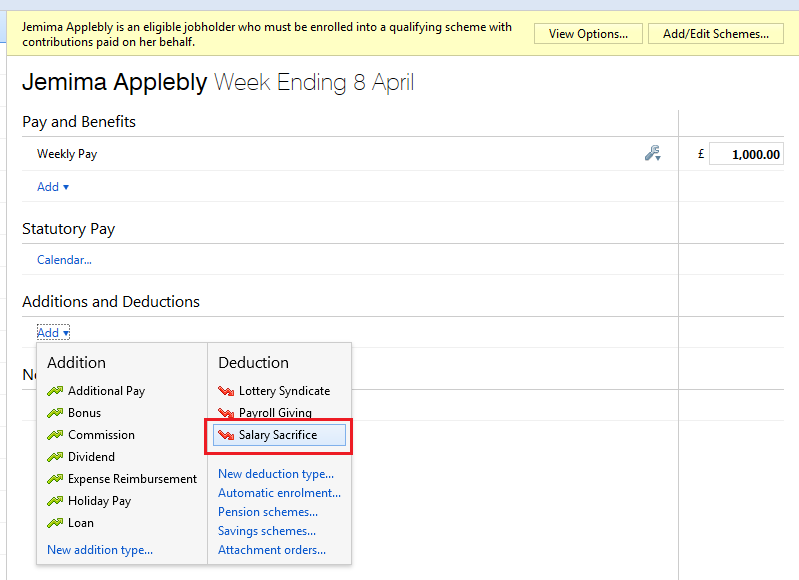

Deducted after tax and National Insurance from your net salary. Click the Add New button. As salary sacrifice arrangements go against the automatic.

The main advantage of salary sacrifice can be higher take home pay as youll be paying lower National Insurance contributions NICs. If you plan to use a salary sacrifice arrangement we recommend that you take independent financial advice. Enter a Fund Name and Scheme Reference.

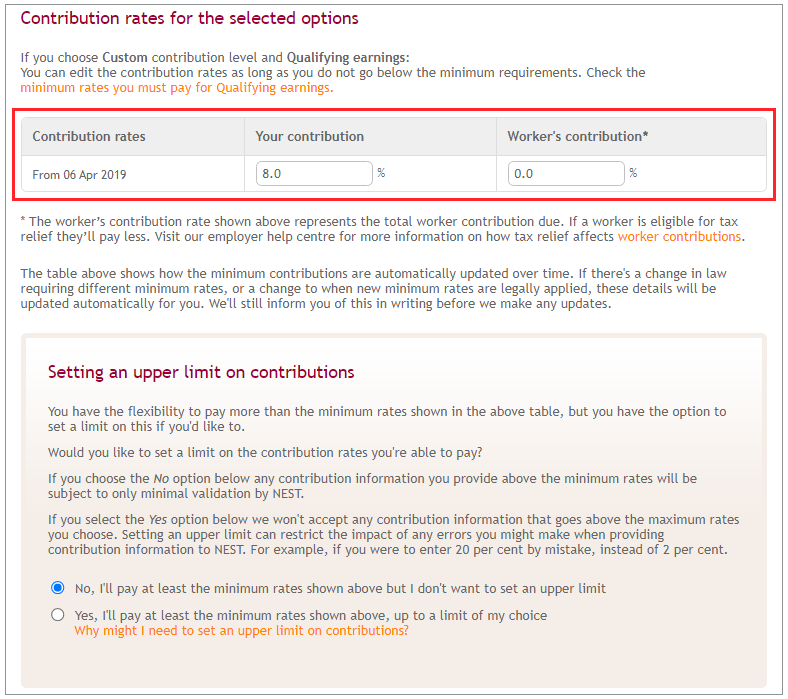

These details will help with setting up salary sacrifice auto enrolment pensions. TPR have confirmed that salary sacrifice will have an effect on the CJRS entitlement to individuals. CJRS limits are set based on the taxable income the employee would have been receiving.

How does auto-enrolment interact with salary sacrifice. Parties to an employment contract have reason to favour the auto-enrolment scheme over other pension arrangements. Auto enrolment requires that employees are automatically enrolled and then given the option to opt out.

Whats the difference between auto-enrolment and a salary sacrifice pension. Salary sacrifice is one of several possible options by which pension contributions can be made. From 1 April 2021 this is 891 per hour for those who are over 25 known as the National Living Wage.

Provides access to non-cash benefits which you cannot buy. Salary sacrifice and tax. Thats why we call this tax basis net Then The Peoples Pension claims the tax relief at the basic 20 rate of tax from the government.

The salary arrangements are also kept flexible. Makes a difference to your total salary. So an automatic enrolment qualifying scheme can use salary sacrifice for example.

Your employer will also pay lower NICs. If for example the non-cash benefit is a pension contribution your employer would pay this along with a contribution they might make directly into your pension pot. There are a few downsides to consider with salary sacrifice.

However the Workplace. Salary sacrifice isnt for everyone its unavailable if it reduces earnings below the minimum wage. What are the downsides of salary sacrifice.

Firstly go into Company Pensions. Salary sacrifice is not likely to affect your entitlement to the state pension unless your lowered salary is under the threshold to make National Insurance contributions. Pension salary sacrifice is when an employee agrees to give up a portion of their taxable salary and in return receives an appropriate pension contribution paid by the employer.

If the employee had entered into a salary sacrifice. Salary sacrifice comes at no additional cost to you or your employer and there are several tax benefits for both parties. Select a Beneficiary from the drop down list.

But thats not to say that salary sacrifice. A salary sacrifice arrangement where cash payments are reduced in exchange for pension contributions can essentially fulfil the auto-enrolment obligation if the required levels of contributions are made by both employer and employee. You might benefit from more pension contributions from your employer if they are giving you some or.

Provides access to cash benefits you can buy but perhaps not afford. The arrangement is effectively a salary sacrifice although directors rarely formalise an agreement with themselves to pay any salary. You starting amount for the state pension may also include a deduction if you were in certain earning-related pension schemes before 6 April 2016 or had certain workplace personal or stakeholder pensions before 6 April 2012.

Salary sacrifice and automatic enrolment are completely separate things. Salary Sacrifice Salary Deduction. With this in mind auto enrolment should make salary sacrifice even more popular as cost savings could help meet employers cost of implementing and administering the scheme.

Please see The Money Advice Service website to understand if this is the right option for you and your employee. HMRC call it relief at source. Doesnt make a difference to your total salary.

Salary sacrifice or salary exchange is an arrangement where an employee gives up part of their salary and in return the employer pays it into their pension pot as an employer contribution. Automatic enrolment is the obligation of an employer to enrol employees into a qualifying scheme. Your employer will also save money as they wont have to pay Employers National Insurance Contributions on the part of your wages that you sacrifice.

Salary sacrifice means you can exchange part of your salary in return for a non-cash benefit from your employer. It combines a valuable tax-efficient employee benefit as well as a cost saving for employers. Salary sacrifice for pension purposes has always been popular.

Privacy Policy Uk Pensions Airbus

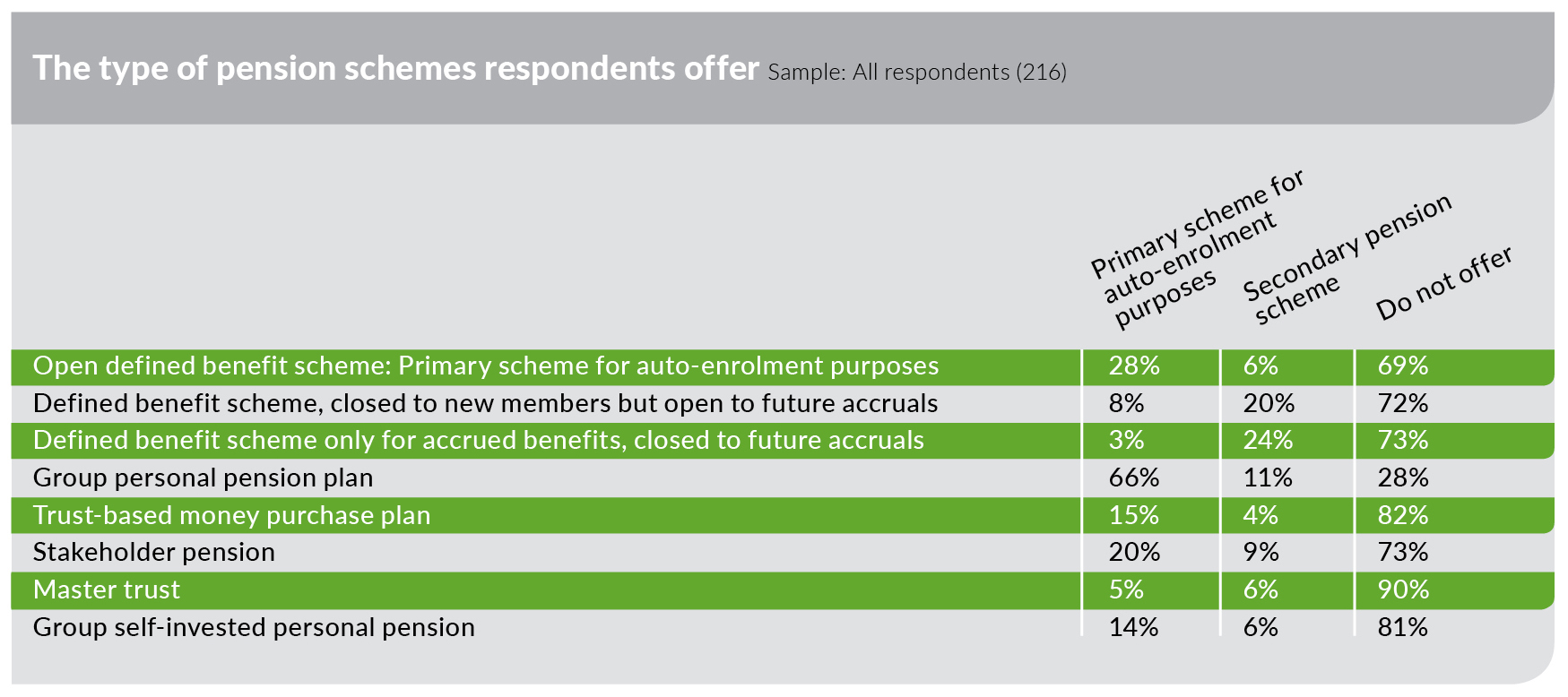

Exclusive 74 Offer Salary Sacrifice Pension Arrangements Employee Benefits

What Does Coronavirus Mean For Salary Sacrifice The Accountancy Partnership

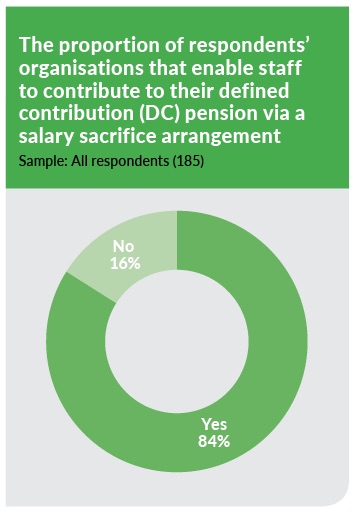

Exclusive 84 Offer Salary Sacrifice Pension Arrangements Employee Benefits

What Is A Salary Sacrifice Pension And How Does It Work Unbiased Co Uk

Salary Sacrifice And Auto Enrolment

Essential Reading Salary Sacrifice

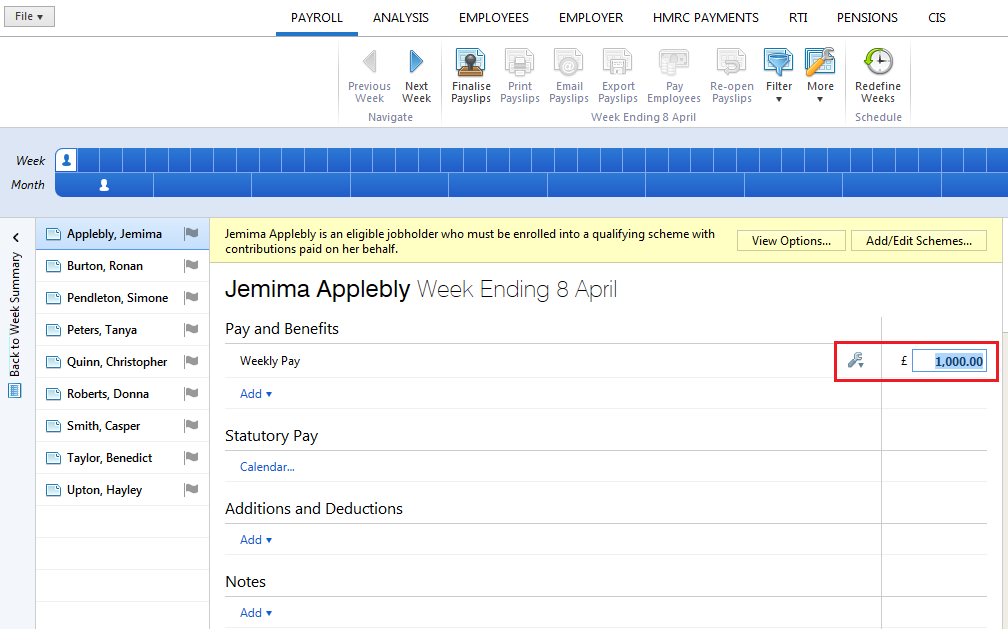

Applying A Salary Sacrifice Arrangement In Brightpay Brightpay Documentation

Https Www Unison Org Uk Content Uploads 2019 06 Salary Sacrifice Pdf

Salary Sacrifice Factsheet Uss

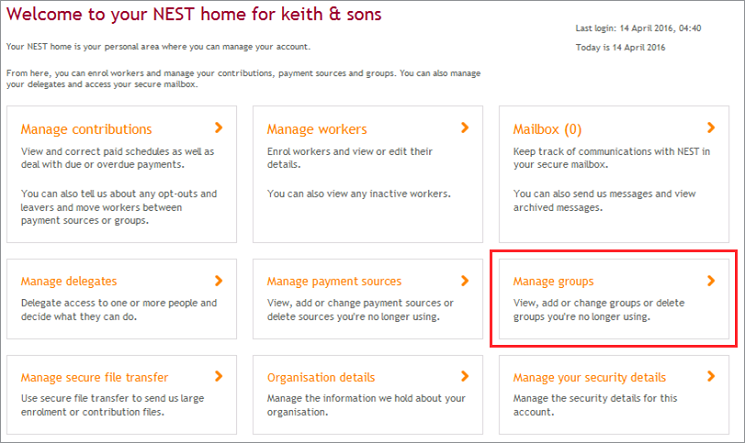

Salary Sacrifice Nest Pensions

Salary Sacrifice Pension Pay Your Employees More For Free Raw Accounting

Salary Sacrifice Pension Advantages Disadvantages Videos Roberts Clark Ifas Celebrating 20yrs Of Online Financial Advice

Https Library Aviva Com Tridion Documents View Epen15a Pdf

Hr Special Is Salary Sacrifice The Future Of Car Ownership In The Uk Fleet Funding

Applying A Salary Sacrifice Arrangement In Brightpay Brightpay Documentation

Salary Sacrifice For Auto Enrolment Brightpay Documentation

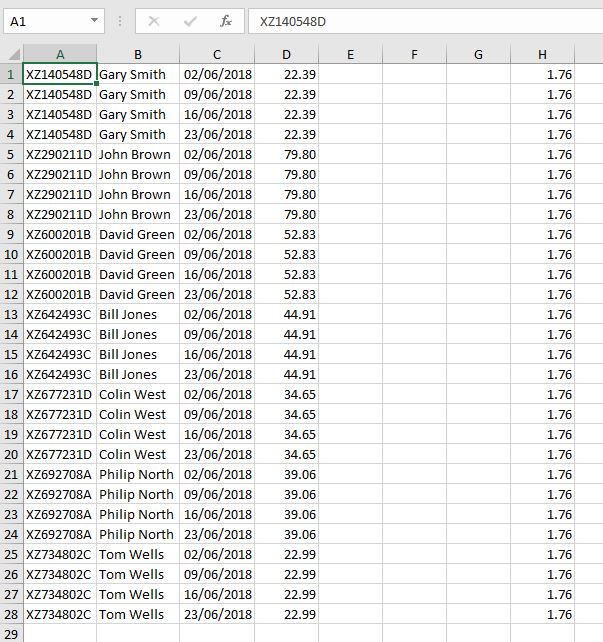

What Is The Pension Contribution Upload File Format For Salary Sacrifice

Exclusive 84 Offer Salary Sacrifice Pension Arrangements Employee Benefits

Post a Comment for "Salary Sacrifice Vs Auto Enrolment"