Gross Monthly Income 63000 Per Year

Gross income per month Annual salary 12. They can do so by multiplying their hourly wage rate by the number of hours worked in a week.

63 000 After Tax De Breakdown July 2021 Incomeaftertax Com

Now lets see more details about how weve gotten this monthly take-home sum of 3765 after extracting your tax and NI from your yearly 63000 earnings.

Gross monthly income 63000 per year. This income tax calculation for an individual earning a 6300000 salary per year. You will pay a total of 12700 in tax this year and youll also have to pay 5120 in National Insurance. Employer Superannuation is payable at 95 of Gross Income.

Here are more examples for the effective gross income formula. Individuals that earn less than 12012 EUR per year are exempt from the Universal Social Charge. The total tax you owe as an employee to HMRC is 17771 per our tax calculator.

PRSI is only applicable to salaries higher than 5000 EUR per year. The resulting number can. Determining hourly pay in a monthly period requires a more complex formula.

The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance. 4874800 net salary is 6300000 gross salary. 63000 after tax and national insurance will result in a 3765 monthly net salary in the tax year 20192020 leaving you with 45180 take home pay in a year.

To determine gross monthly income from salary individuals can divide their salary by 12 for the number of months in a year. If you earn 21500 a year then after your taxes and national insurance you will take home 18260 a year or 1522 per month as a net salary. Income Income Period.

Joaquin makes 11 per hour as a waiter working 20 hours per week. Yearly Monthly 4 Weekly 2 Weekly Weekly Daily Hourly 1. See how we can help improve your knowledge of Math Physics Tax Engineering and.

One of a suite of free online calculators provided by the team at iCalculator. If you earn 63000 in a year you will take home 45180 leaving you with a net income of 3765 every month. Hourly pay x hours worked 11 x 20.

On a monthly basis the effective gross income is 756000 12 or 63000. While this is an average keep in mind that it will vary according to many different factors. Salary and Tax Illustration.

You will pay a total of 12700 in tax per year or 1058 per month. If you earn 28000 a year then after your taxes and national insurance you will take home 22680 a year or 1890 per month as a net salary. With her yearly income amount she can now divide by 12 for the months in the year to determine her gross monthly income.

The following are only generalizations and are not true for everyone especially in regards to race ethnicity and gender. In the first quarter of 2020 the average salary of a full-time employee in the US. Miss Avasarala finds that she makes 1040 per month.

Pay Related Social Insurance PRSI is a tax payable on the gross income after deducting pension contributions. Based on a 40 hours work-week your hourly rate will be 1033 with your 21500 salary. If you earn 70000 a year then after your taxes and national insurance you will take home 49240 a year or 4103 per month as a net salary.

Since there are 12 months in a year you can estimate the average monthly earnings from your 63000 salary as 525000 per month. 6300000 After Tax. To determine gross monthly income from hourly wages individuals need to know their yearly pay.

Is a progressive tax applied on the gross income after certain capital allowances but before pension contributions. Effective Gross Income Multiplier EGIM. 21500 Salary Take Home Pay.

Employer Superanuation for 2021 is payable on all employee earning whose monthly income exceeds 45000 which equates to 540000 per annum. Based on a 40 hours work-week your hourly rate will be 3030 with your 63000 salary. To find his annual income he multiplies his hourly wage by the hours of work he puts in each week.

What is a 63k after tax. 28000 Salary Take Home Pay. Alberta 6300000 Salary after Tax Calculations.

Of course some months are longer than others so this is just a rough average. Is 49764 per year which comes out to 957 per week. Gross monthly income 12480 12 Gross monthly income 1040.

Our salary calculator indicates that on a 63000 salary gross income of 63000 per year you receive take home pay of 45229 a net wage of 45229. Based on a 40 hours work-week your hourly rate will be 3365 with your 70000 salary. Income Income Period.

63000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2021 tax return and tax refund calculations. Thus in doing our calculations here we assumed 2 percent for insurance and property tax and 34 percent for. Income Income Period.

Gross monthly income 3750. 70000 Salary Take Home Pay. Based on a 40 hours work-week your hourly rate will be 1345 with your 28000 salary.

Lenny makes 3750 per month. 63000 Salary Take Home Pay If you earn 63000 a year then after your taxes and national insurance you will take home 45180 a year or 3765 per month as a net salary. Research Maniacs checked with different financial institutions and found that most mortgage lenders do not allow more than 36 percent of a gross income of 63000 to cover the total cost of debt payment s insurance and property tax.

Gross Salary - Income Tax After deductions 5229436.

Is 63 000 A Good Salary In Berlin

Quick Answer Take Home Salary Calculator India Kerala Travel Tours

63 000 After Tax After Tax Calculator 2019

63 000 After Tax Take Home Pay Calculator 2021

63 000 After Tax Income Tax Calculator 2019

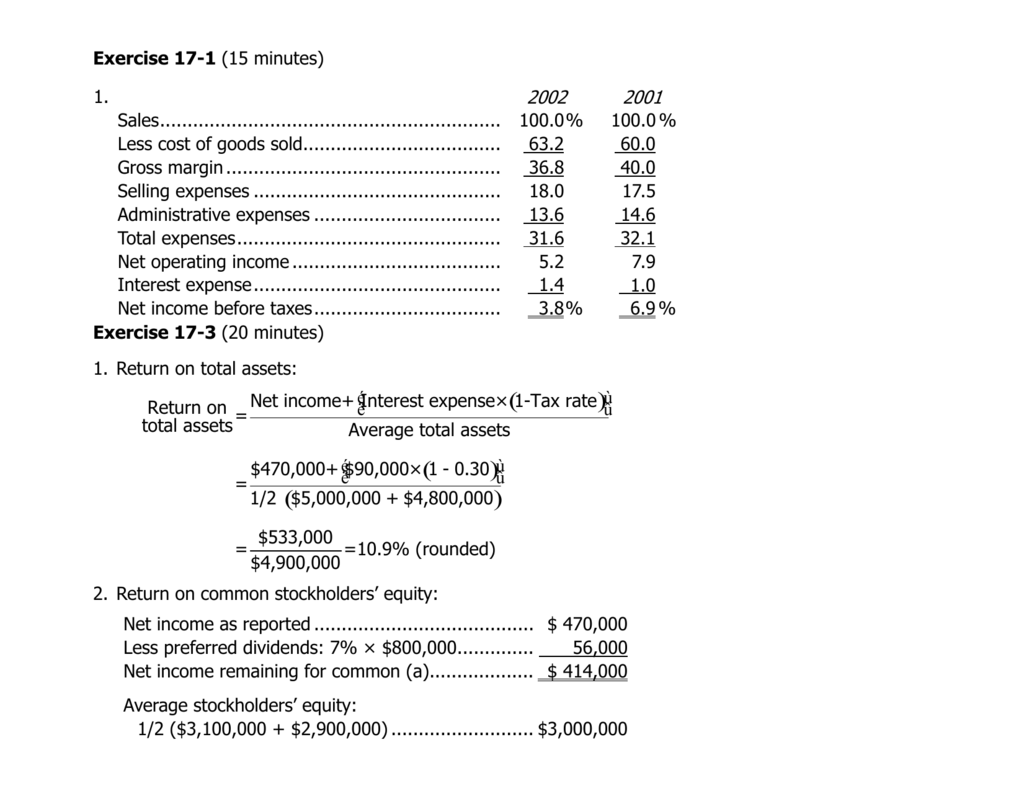

Examen Accounting 2 Segundo Examen Docsity

63 000 After Tax 2021 Income Tax Uk

60 000 A Year Is How Much An Hour And Why It S Great Stack Your Dollars

Gross Net Salary The Urssaf Converter

Family Farmers Are They Paupers Or Princes By Natasha Paris Medium

Is 60 000 Euros A Good Salary In Germany Quora

How I Spend My Money A 28 Year Old Doctor Commuting From Dublin To The Midlands On 63 000

Post a Comment for "Gross Monthly Income 63000 Per Year"