Gross Annual Income Universal Credit

Remission based on income. Disregards in Universal Credit.

Understanding Universal Credit For Employers How Universal Credit Works

Unless the application specifies otherwise this is usually what the issuer is looking for.

Gross annual income universal credit. Your gross income minus taxes and other expenses like a 401k contribution. People with savings above 16000 will not be eligible for UC. It may come from employment non-means-tested benefits such as Attendance Allowance Disability Living Allowance or Personal Independence Payment.

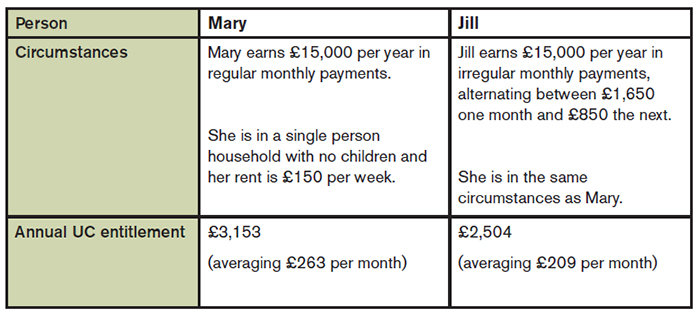

Its paid monthly - or twice a month for some people in Scotland. How much National Insurance you paid. Universal Credit Plaintiffs Can Lose 1040 Annual Income Overnight I was embarrassed for most of my life but Im not afraid anymore-Cannabis Health News.

Details of any contributions made to a pension scheme and whether they are paid from your gross. Heres how the amount of capital you have will affect your Universal Credit claim. Monthly income requirement.

On switching to the cash basis and from it to the accruals basis. If it is not specifically included as either of these then it will be disregarded. When you phone to report your earnings yourself you will need to provide.

There are no transitional rules. In other words what you end up. Any capitalsavings you have worth between 6000 and.

The assessment period begins with the first date of entitlement and. If your savings are between 6000 and 16000 it will be treated as if youre receiving an income from this money when calculating your Universal Credit. A Taper Rate of 63 means losing 63p of your maximum Universal Credit award for every 1 you earn over your Work Allowance.

An income of 1week will be assumed for every 250 of savings over 6000 up to a maximum savings level of 16000. How much Universal Credit you actually get in any month will be based on the amount of earnings in the RTI system so its important its correct. Your gross annual income is the amount you earn before any deductions such as income tax withholding employee benefit costs or retirement plan contributions are deducted from your pay.

Income for Universal Credit purposes will be treated as earned income or unearned income. No annual fee for life Interest rate. La Commission européenne veut en effet remettre au goût du jour sa directive sur les contrats de crédit aux consommateurs datant de 2008 qui impose un socle réglementaire minimal et commun en Europe.

The importance of determining whether income is earned or unearned can be seen in the calculation of UC entitlement. Your gross taxable pay. Universal Credit is a payment to help with your living costs.

What is income for UC. Here are a few terms you might see when asked for your annual income on credit card applications. Informs the public that the French and English versions of its 2020 Universal Registration Document and Annual Financial Report have been registered with the French Financial Market Authority AMF on March 24 2021 under number D21-0184.

For every 1 of the remaining 207 you get 63p is taken from your Universal Credit payment. Savings in Universal Credit are to be treated in the same way as in means tested benefits. How much tax you paid.

Any capitalsavings you have under 6000 is ignored. When completing their self-assessment tax returns Universal Credit claimants must adjust their annual accounts to ensure that income and expenses are only declared once. Gross annual income is income before tax.

You may be able to get it if youre on a low income out of. Your earnings will be assessed monthly to ensure your Universal Credit award is always accurate. The DWP will take off 435 a month for each 250 or part of 250 of capital above 6000.

Universal Credit claimants must leave the cash basis if their annual turnover is greater than 300000. Your total annual income before anythings taken out. Employer News Immedis Announces Automation Solution to Simplify and Streamline Delivery of International Payments.

Crédit Agricole SA. The home you live in If you have more than 6000 of capital it will reduce your Universal Credit payments. This means you can earn 293 without any money being deducted.

Linstauration en 2022 dune forme de tiers payant pour le crédit dimpôt versé aux particuliers utilisant un service à domicile devrait contribuer à créer 150 à 200 000 emplois dans les trois ans à venir en partie en les sortant du travail au noir a estimé jeudi la Fédération du service aux particuliers FESP. This income will be 435 for each 250 or part of 250 you hold regardless of whether you receive any income from your savings or not. Where your annual net income is how much you bring home in your actual paychecks after deductions are taken out your gross income is how much you earn before deductions and taxes are.

12000 they may be eligible for a 50 reduction of the fee. If the donors gross annual income is less than. If your annual salary is 48000 your gross monthly income would be 48000.

PHP 15000 for those with another credit card and PHP 20833 for first-time cardholders Annual fee. Earned income is subject to a 63 taper whereas unearned. For example the DWP will take off 435 if you have.

The Taper Rate is the rate at which your maximum Universal Credit award is reduced as your earnings increase. Un certain nombre dÉtats membres ont appliqué la directive 200848CE à des domaines qui ne relèvent pas de son champ dapplication afin de relever le niveau de protection des. So 207 x 063 13041.

Savings below 6000 will have no effect. The date you were paid.

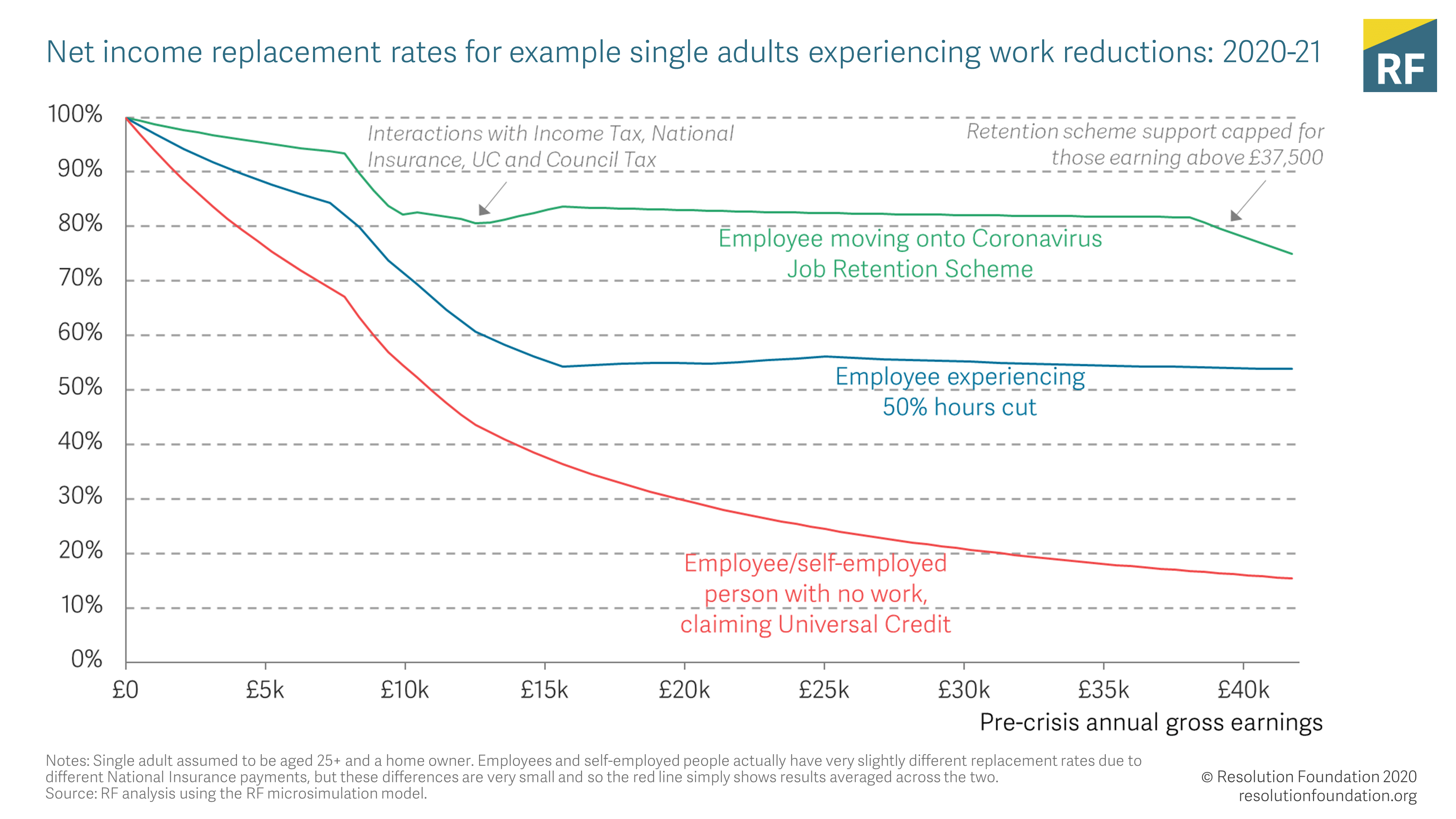

Next Steps To Support Family Incomes In The Face Of The Coronavirus Crisis Resolution Foundation

Https Www Cne Siar Gov Uk Media 4664 Ema Applicationguidance Pdf

Universal Credit Factsheet Pma Accountants

Understanding Universal Credit How Earnings Affect Universal Credit

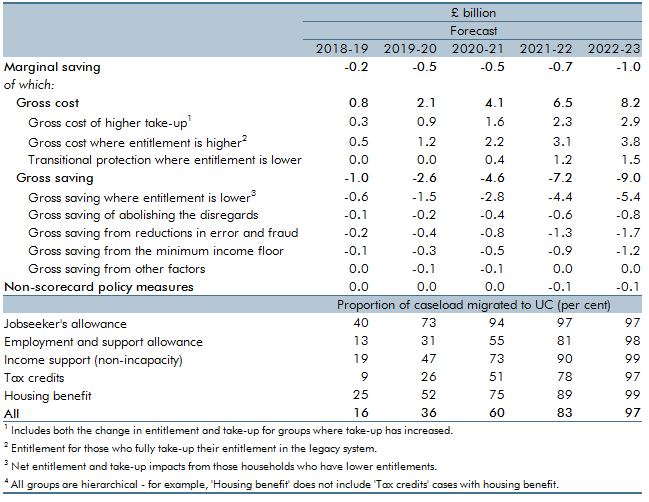

Welfare Spending Universal Credit Office For Budget Responsibility

Understanding Universal Credit For Employers How Universal Credit Works

Http Www Oecd Org Officialdocuments Publicdisplaydocumentpdf Cote Eco Wkp 2018 12 Doclanguage En

Universal Credit Factsheet Pma Accountants

Http Www Oecd Org Officialdocuments Publicdisplaydocumentpdf Cote Eco Wkp 2018 12 Doclanguage En

Single Dad On Universal Credit Gets Nothing For 2 Months Because Of Pay Cheque Glitch Here S How To Avoid The Same Trap

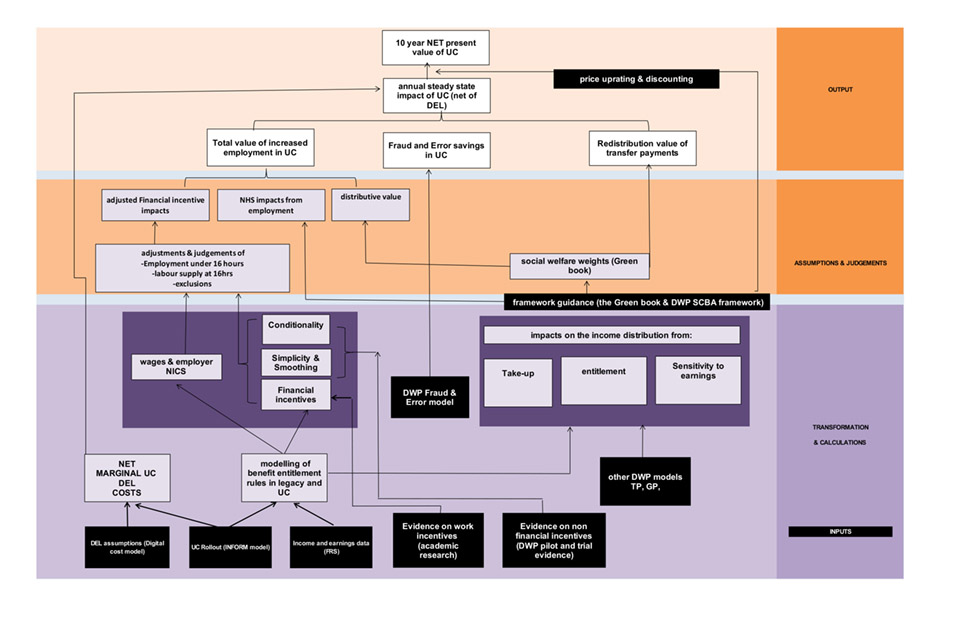

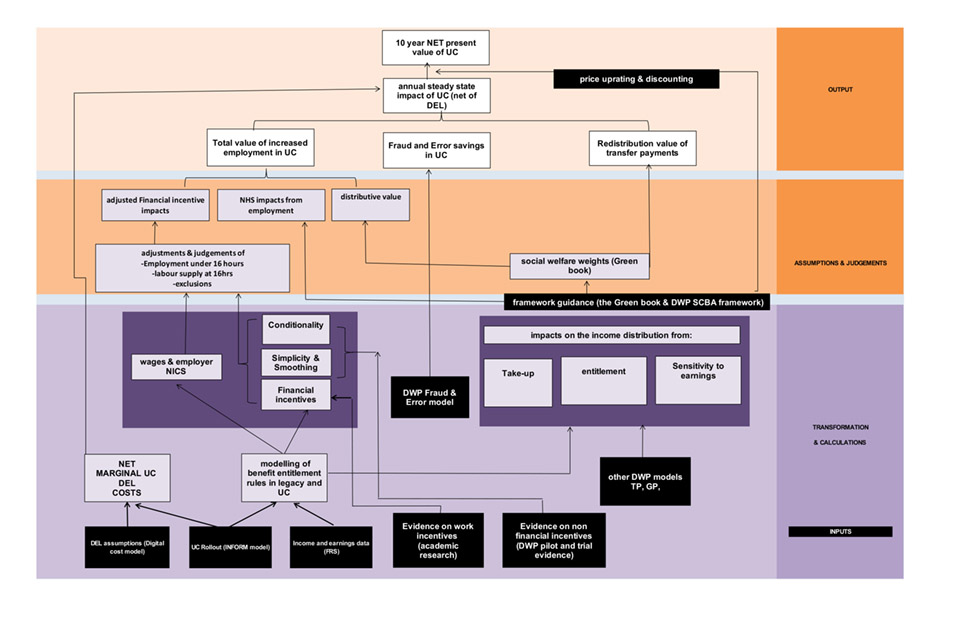

Universal Credit Programme Full Business Case Summary Gov Uk

Universal Credit Will Be A Disaster For The Self Employed Who Is Listening Rsa

Http Www Oecd Org Officialdocuments Publicdisplaydocumentpdf Cote Eco Wkp 2018 12 Doclanguage En

Https Www Lbbd Gov Uk Sites Default Files Attachments Universal Credit Full Service A Guide For Las V1 Pdf

Universal Credit And Employee Pay Low Incomes Tax Reform Group

The Effects Of Taxes And Benefits On Household Income Financial Year Ending 2018 Office For National Statistics

Https Www Ifs Org Uk Uploads Publications Bns Universal 20credit 20and 20its 20impact 20on 20household 20incomes 20the 20long 20and 20the 20short 20of 20it 20bn248 Pdf

Https Www Lbbd Gov Uk Sites Default Files Attachments Universal Credit Full Service A Guide For Las V1 Pdf

Universal Credit Factsheet Pma Accountants

Post a Comment for "Gross Annual Income Universal Credit"