Salary Sacrifice Redundancy Payment

Certain redundancy payments are tax-free up to a limit based on the number of years you worked for that employer. The tax-free redundancy payment up to 30000 ie.

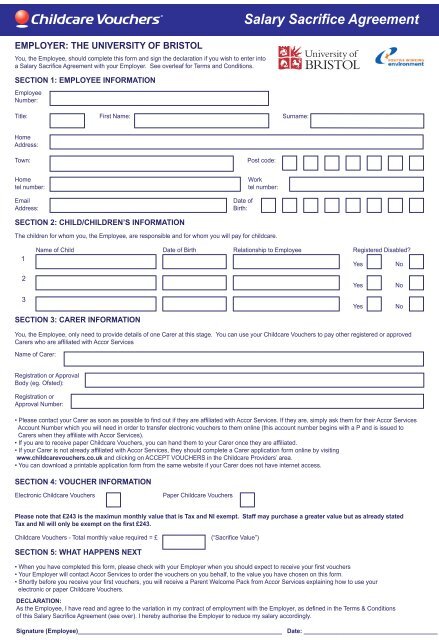

Prr Pay Salary Sacrifice Agreement Letter Template Hr Expert

The benefit must be provided by you.

Salary sacrifice redundancy payment. Redundancy pay and ETPs are not deemed salary and wages for the purpose of salary sacrifice. An example of a salary sacrifice is where your employee gives up some of their pay for a travel pass. Furlough is an example of payment based on after sacrifice salary.

Hi - I do hope that someone can help me - as Ive had differing advice from my employer - which is confusing me - and I dont know where to go for advice. Salary sacrifice is where your employee agrees to give up some of their pay in exchange for a benefit. There appears to be some confusion over whether this is possible as a colleague has stated that under the tax regulations all notice pay is required to be taxed.

They have requested that we use Salary Sacrifice to pay the PILON straight into their pension Redundancy Sacrifice to avoid an immediate high tax charge and NI. Sacrificing contractual redundancy payments for a pension contribution can also affect funding for high earners who could become caught by the tapered annual allowance. Salary sacrifice is not likely to affect your entitlement to the state pension unless your lowered salary is under the threshold to make National Insurance contributions.

If large enough it could bring it below 110000 - reinstating the full 40000 allowance. The only exception to this is where the employer has agreed a shadow salary the pre-sacrifice figure to be used for certain deductions. SJ Posts6 JoinedWed Aug 06 2008 344 pm.

Redundancy Payments and Salary Sacrifice. It can also be used to maintain the level of pension contribution and increase pay. Were unable to process tax payments on a gross basis anymore.

Donald agrees with his employer that he will sacrifice the first three items of his package and 2000 of the redundancy payment in exchange for an employer contribution of 7000. This will mean that the amount sacrificed will be added to the clients threshold income. Beyond this its worth considering saving and investing a redundancy payment and one way to minimise the tax you pay is utilising salary sacrifice meaning your.

The fact that they NOT mentioned in the Salary Sacrifice Ruling is sufficient to say they cannot be sacrificed. How salary sacrifice can work for you The contribution you make into an employees pension is not liable for tax or NIC and it does not cost you anything extra. As the salary is sacrificed before being paid both you and your employee.

However an individual contribution will reduce threshold income. These excluded exemptions are. Salary sacrifice also referred to as salary exchange is when an employee agrees to exchange part of their gross salary in return for a non-cash benefit for example a pension contribution.

Redundancy Payments and Salary Sacrifice. What the employee receives in their final period of employment that is their normal taxable pay will be subject to the same automatic enrolment deductions as normal ie. Pension contributions and employer-provided pensions advice.

The new salary sacrifice arrangements will count as threshold income as well as adjusted income. Salary sacrifice arrangements. Redundancy payments are a type of employment termination payment ETP.

Post by SJ Mon Aug 23 2010 456 pm. The problem can be made worse by sacrificing some of the taxable redundancy payments for an employer pension contribution. You starting amount for the state pension may also include a deduction if you were in certain earning-related pension schemes before 6 April 2016 or had certain workplace personal or stakeholder pensions before 6 April 2012.

A tax exemption exists for certain salary sacrifice arrangements. So earn 3k a month sacrifice 15k can only get 80 of 15k. Its likely that a redundancy sacrifice will require a new salary exchange agreement.

Once agreed the new post-sacrifice salary is generally the correct figure to use when calculating notice pay or redundancy pay death in service or pension contributions. 3 posts Page 1 of 1. Contribute your Termination Payment in Super as Contributions and also salary sacrifice some more payments from your salary on top of it with out breaching cap 25k You contribute 25k including your SG.

These sorts of people are likely to have company secrets and other sensitive. The ATO website wording also assists re ETPs Sacrificing bonuscommissionincentive. If as a result of COVID-19 you are taking leave have been stood-down or have lost your job see Tax on employment payments.

The lump sum the employee is getting for being made redundant isnt counted as pensionable earnings and therefore isnt subject to pension deductions. Salary sacrifice can be used to boost pension savings for your employees while leaving their net spendable income unchanged. Salary sacrifice schemes that are excluded exemptions that continue to offer a tax and national insurance benefit mean that employers also do not need to value the benefit item nor report to HMRC for a salary sacrifice arrangement.

The same or very similar. The employees likely to be caught up in serious salary sacrifice where this becomes a material worry are likely to be better paid and better experienced qualified. New rules from HM Revenue Customs could allow savers who deposit redundancy payments into their pension via salary sacrifice to avoid.

Benchmarking Redundancy Payments Pdf Free Download

Can I Put Redundancy Into Super Super Guy

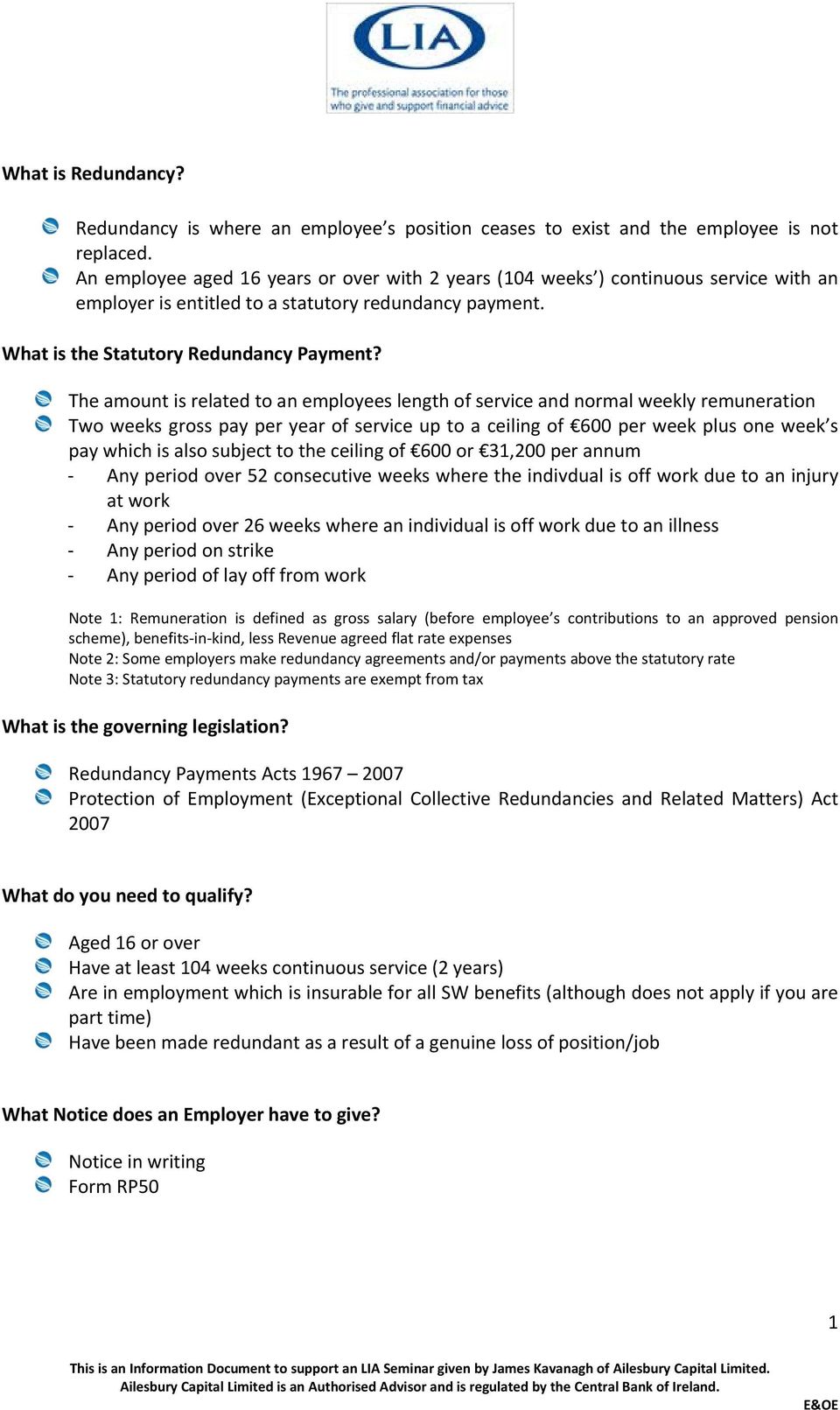

What Is Redundancy What Is The Statutory Redundancy Payment Pdf Free Download

Benchmarking Redundancy Payments Pdf Free Download

Https Northumbriasport Com Media Download 835

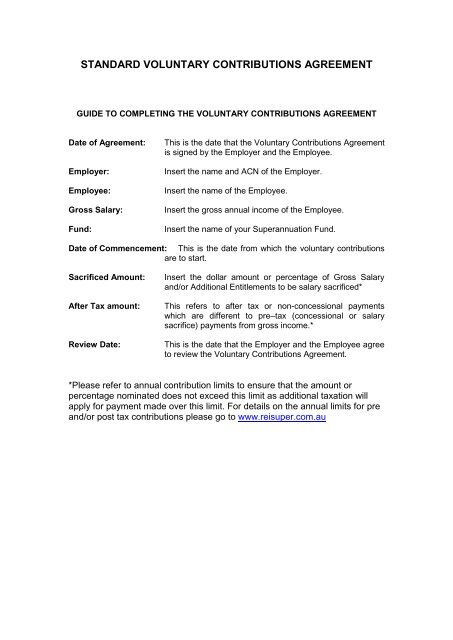

Standard Salary Sacrifice Agreement Rei Super

Salary Sacrifice For Auto Enrolment Brightpay Documentation

Https Www Unison Org Uk Content Uploads 2019 06 Salary Sacrifice Pdf

Https Home Kpmg Content Dam Kpmg Uk Pdf 2019 05 Termination Payment Update Pdf

Benchmarking Redundancy Payments Pdf Free Download

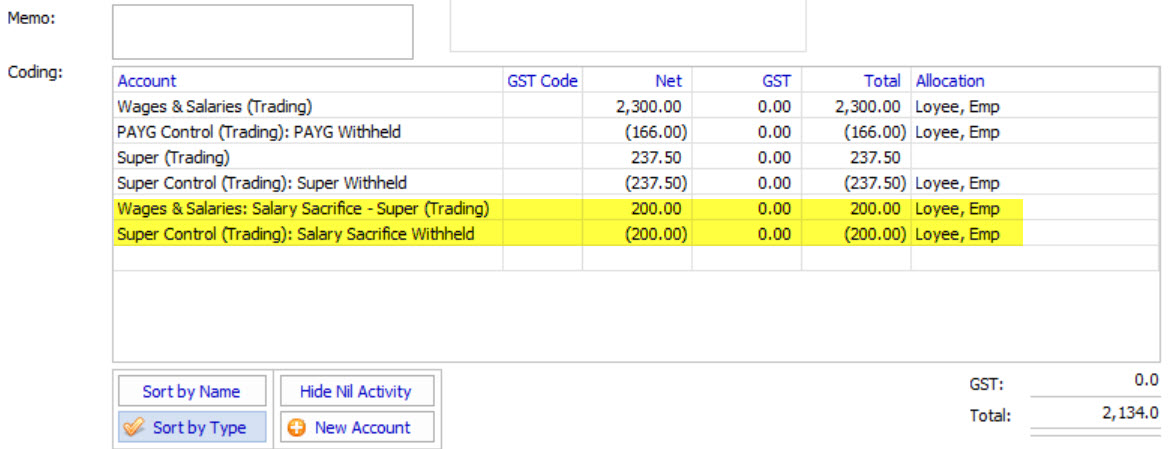

How To Enter Wages Entries Having A Salary Sacrifice Component Exalt

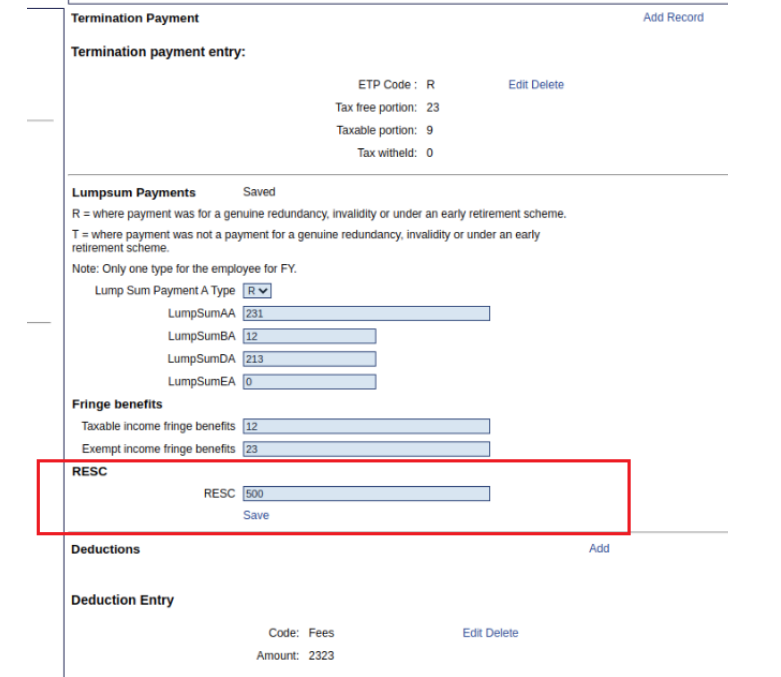

Payroll Guru End Of Financial Year Eofy Single Touch Payroll Stp Easyemployer Support

Changes To Tax Treatment Of Termination Payments By Howard Kennedy Llp Issuu

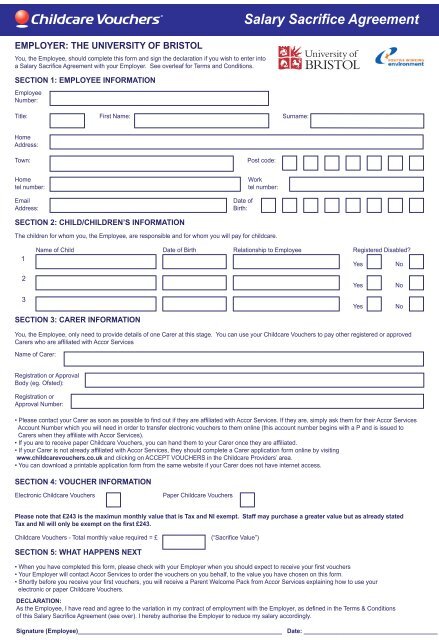

Salary Sacrifice Agreement University Home

Content Mercer Super Trust Australia

Benchmarking Redundancy Payments Pdf Free Download

What Happens If I M Made Redundant A Guide Crunch What Happens If I M Made Redundant A Guide Crunch What Happens If I M Made Redundant A Guide Crunch

What Happens If I M Made Redundant A Guide Crunch What Happens If I M Made Redundant A Guide Crunch What Happens If I M Made Redundant A Guide Crunch

How To Enter Wages Entries Having A Salary Sacrifice Component Exalt

Post a Comment for "Salary Sacrifice Redundancy Payment"