Salary Sacrifice New Zealand

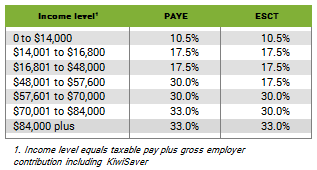

KPMGs salary sacrifice meant staff who earned more than 55000 a year were asked to reduce their salaries by 15 per cent from May to August in return for 12 days of special leave. For employees who earn between 14001 to 16800 48001 to 57600 and 70001 to 84000 salary sacrifice results in higher net-of-tax remuneration because of lower tax.

New Zealand Employee Share Schemes New Reporting Rules Activpayroll

An Independent Earner Tax Credit IETC of has been applied.

Salary sacrifice new zealand. Tax on sacrificed contributions between 39520 and 60000 is the same as it would have been had it been paid as salary 33 so there is no tax saving there. The arrangement needs to be in place before you perform the relevant work. There cannot be any future access to the salary that is sacrificed.

If you have a workplace issue you may want to use the Early Resolution Service to resolve it early quickly and informally. There needs to be an agreement between yourself and your employer. Deductions are from your pre-tax salary.

She also contributes 4. Extreme salary sacrifice amongst our membership of around 76000 employers is almost impossible to ascertain. The lease can be structured for your specific requirements.

It also changes your tax code. During IRDs consultation with Business New Zealand IRD did concede that finding hard evidence was indeed difficult which in turn has meant the document also lacks any. Further details about each contribution type and when it is payable are noted in this section.

Make sure you are locally compliant with Papaya Global help. It is entirely voluntary and all brokerage fees excluding sell transactions are met by the company. It is also cutting partner.

All finance and running costs are GST exclusive. Salary sacrificing is a tax effective way for employees to maximise nett earning capacity. Requirements for an effective salary sacrifice arrangement.

Any documented salary sacrifice agreements in place. Regular contributions for both the employee and employer are calculated as a percentage of Gross Base Salary paid in each payroll run. 322 What remuneration payments are superable for SSRSS members.

Abbott employees in Australia and New Zealand have the opportunity to acquire shares in Abbott through the Company Share Ownership Plan. Allows you to select a vehicle of your choice in a salary package. Make sure you are locally compliant with Papaya Global help.

Sandy earns 100000 per year. KPMG has asked staff to take a 15 per cent pay cut calling it a salary sacrifice needed since it doesnt qualify for the government wage subsidy. Global salary benchmark and benefit data.

The reason for turning the amount between 39520 and 60000 into an employer contribution is to do with the way PIE income is taxed see d below. This reduces the amount of PAYE you pay. SSCWT of 33 will be payable on the whole of this salary sacrifice.

Abbott employees can arrange to salary sacrifice superannuation contributions. Annonce Payroll Employment Law for 140 Countries. This includes payments made for periods of annual.

WESFARMERS EMPLOYEE SHARE OWNERSHIP PLAN NEW ZEALAND APPENDIX 3B Attached is an Appendix 3B announcing the allotment and seeking quotation of 86784 fully paid ordinary shares allotted on 9 January 2009 at a price of 187160 per share to employees under the companys deferred and ex empt salary sacrifice share plans and the. Discounts on vehicles maintenance tyres and fuel from ORIX suppliers. The Government is proposing to establish four publicly-owned entities to take responsibility of drinking water wastewater and stormwater infrastructure across New Zealand saving ratepayers thousands of dollars and better ensuring the 120 to 185 billion investment.

In order for a salary sacrifice arrangement to be implemented the following conditions have to be satisfied. If you dont qualify for this tax credit you can turn this off under the IETC settings. They do this by arranging a dramatic reduction in their salary in return for a.

The government will introduce legislation to minimise the use of excessive salary sacrifice as a means of paying less tax Finance Minister Michael Cullen and Revenue Minister Peter Dunne announced today. For employees earning less than 84000 a benefit arises if it lowers the tax rate otherwise applicable. She salary sacrifices 4 per cent of her income in exchange for a contribution of the same amount from her employer.

Global salary benchmark and benefit data. KPMG staff back on full pay after Covid 19 salary cut New Zealand Herald. In many cases high-income employees sacrifice their salary merely to reduce their income tax.

Annonce Payroll Employment Law for 140 Countries. Employers must pay the minimum wage to all employees including adults trainees starting-out workers and people with disabilities some exemptions may apply.

New Zealand Tax Schedule For Personal Income Tax Download Table

Hays Salary Guide 2014 Australia New Zealand

Pdf Labour Force Participation And Gdp In New Zealand

New Zealand Packing List Written By A Kiwi New Zealand Travel Packing List For Travel Packing Checklist

New Zealand A Sharp Increase In The Fringe Benefits Tax Willis Towers Watson

Hays Salary Guide 2014 Australia New Zealand

Hays Salary Guide 2014 Australia New Zealand

A Future In New Zealand Overseas Advice For New Zealand Employers

New Zealand Tax Schedule For Personal Income Tax Download Table

New Zealand Rsa Newzealandrsa Twitter

Famous Indian Vedic Astrologer In Auckland New Zealand Durga Matha Astrology Vedic Astrology Healing Solutions

United Kingdom Pension Reform Infographic Blog Marketing Infographic Business Blog

Monopoly New Zealand Edition With Cards For Christchurch Streets Growing Up Memory Lane Nostalgia

New Zealand Rsa Newzealandrsa Twitter

Calculating Annual Holiday Payment Rates Employment New Zealand

New Zealand Fun New Zealand Maori Art New Zealand Word Searches Free Printable

New Zealand Raises Minimum Wage And Increases Taxes On The Rich New Zealand The Guardian

Post a Comment for "Salary Sacrifice New Zealand"