Net Salary Calculator Uk Gov

Salary after tax and national insurance contribution is calculated correctly by assuming that you are younger than 65 not married and with no pension deductions no childcare vouchers no student loan. Enter the gross wage per week or per month and you will see the net wage per week per month and per annum appear.

Salary And Tax Deductions Calculator The Accountancy Partnership

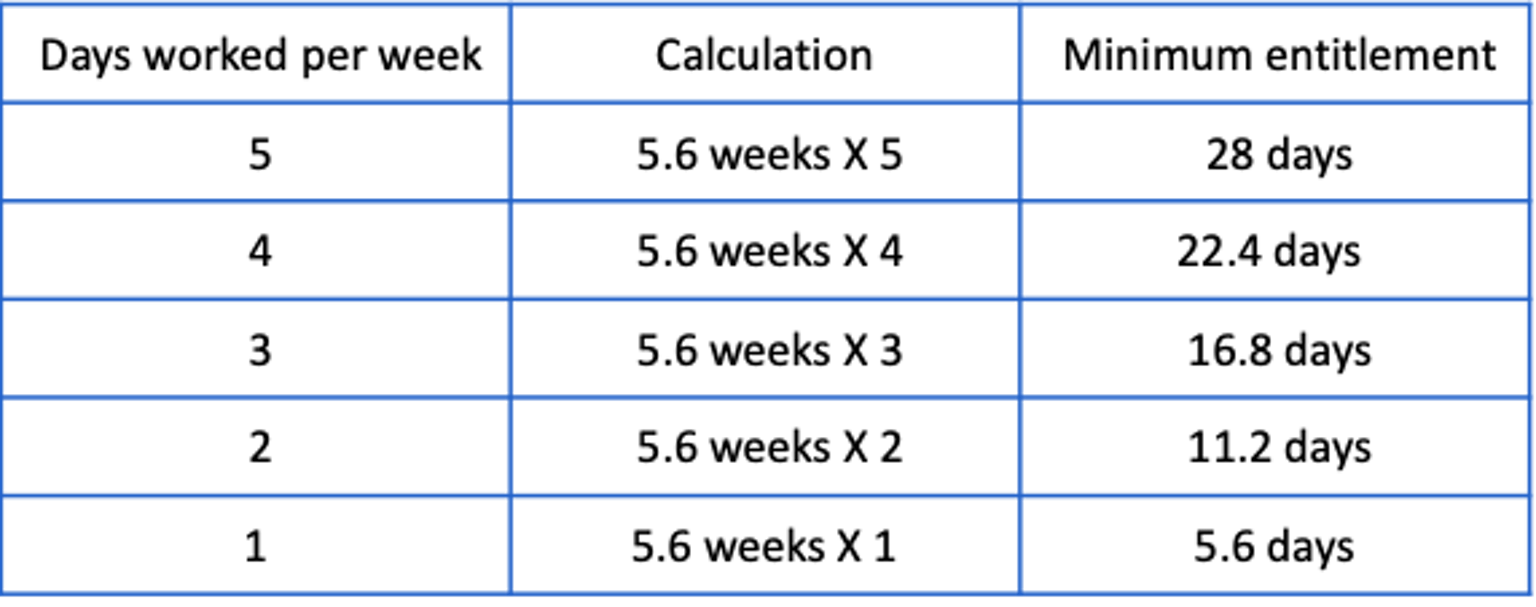

Find out if you can get maternity paternity or shared parental leave for employees.

Net salary calculator uk gov. If you are looking for a feature which isnt available. Calculate your leave and pay when you have a child. Find out your take-home pay - MSE.

More information about the calculations performed is available on the about page. Find out the benefit of that overtime. Enter the number of hours and the rate at which you will.

Why not find your dream salary too. Our salary calculator will provide you with an illustration of the costs associated with each employee. An accurate breakdown of your pay is provided by incorporating the calculations for the following common pay allowances and deductions.

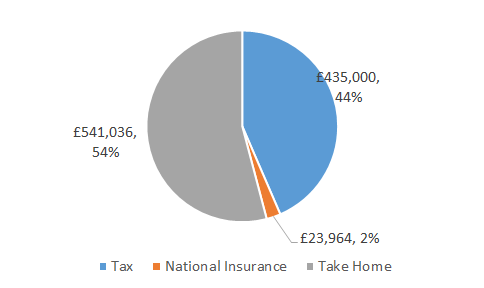

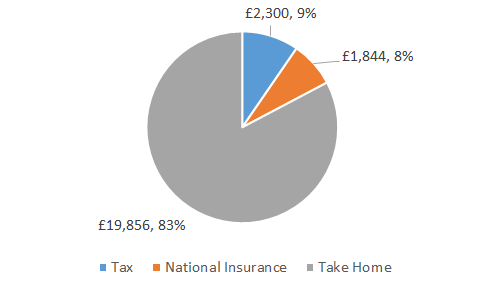

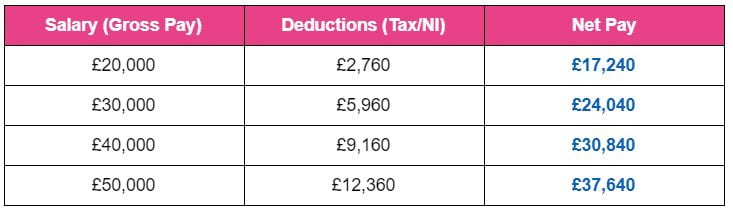

UK Tax Salary Calculator Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. Our Salary Calculator is a fast and simple tool to help you estimate your take-home pay based on your earnings. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself.

A full-time worker on minimum wage could therefore expect to earn at least 31185 per week 135135 per month or 1621620 per year before tax and other deductions. Completed overhauled for 2019-19 tax year our new salary and tax calculator is built to support all your salary and payroll audit needs. If you have HELPHECS debt you can calculate debt repayments.

UK PAYE Tax Calculator 2021 2022. How to use the Take-Home Calculator. And you can figure out are you eligible for and how much of Low Income Tax Offset you.

The Tax Calculator uses tax information from the tax year 2021 2022 to show you take-home pay. We offer you the chance to provide a gross or net salary for your calculations. Please note where a net salary has been agreed the employer will be covering the employees pension contribution in addition to their own.

The latest budget information from April 2021 is used to show you exactly what you need to know. Hourly rates weekly pay and bonuses are also catered for. We strongly recommend you agree to a gross salary.

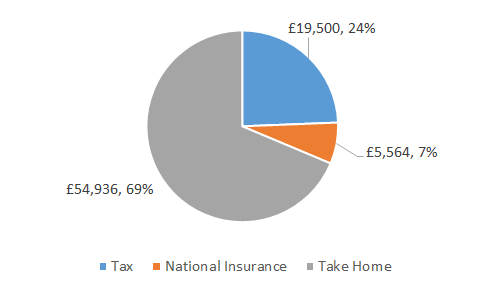

If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. To use the tax calculator enter your annual salary or the one you would like in the salary box above. See where that hard-earned money goes - with UK income tax National Insurance student loan and pension deductions.

This income tax calculator or net salary calculator or take home pay calculator is a simple wages calculator displaying a list of already calculated net salary after tax for each possible salary level in the UK. Use the calculator to work out what your employee will take home from a gross wage agreement. Use the calculator to work out an approximate gross wage from what your employee wants to take home.

In the UK your salary is subject to Income Tax and National Insurance contributions. The tool estimates your net income based on the Income Tax you will be deducted and the NI contributions you will be required to pay. The Salary Calculator will also calculate what your Employers Superannuation Contribution will be.

The above figures place the UK in 9th place in the International Labour Organisations 2018 ranking of. Developed by a Camden resident this website helps you calculate your take home net pay or gross to net salary. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022.

Calculate your monthly net pay based on your yearly gross income with our salary calculator. This tells you your take-home pay if. This Australian Salary Calculator will show you what your weekly fortnightly monthly Income or Net Salary will be after PAYG tax deductions.

This UK Tax Calculator will make light work of calculating the amount of take home pay you should have after all income tax deductions have been considered. Enter the net wage per week or per month and you will see the gross wage per week per month and per annum appear. UK Salary Calculator Accurate fast and user friendly UK salary calculator using official HMRC data.

Please note where a net salary has been agreed the employer will be covering the employees pension contribution in addition to. Calculate your take-home pay given income tax rates national insurance tax-free personal allowances pensions contributions and more. The 201920 tax calculator provides a full payroll salary and tax calculations for the 201920 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations and more.

You will see the costs to you as an employer including tax NI and pension contributions. SalaryBot will automatically check to see if youre being paid the minimum wage for your age group. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features.

80 000 After Tax 2021 Income Tax Uk

Net Salary Calculator Uk 2021 Income Tax Calculator Take Home Pay Calculator Wage Calculator

Comparison Of Uk And Usa Take Home The Salary Calculator

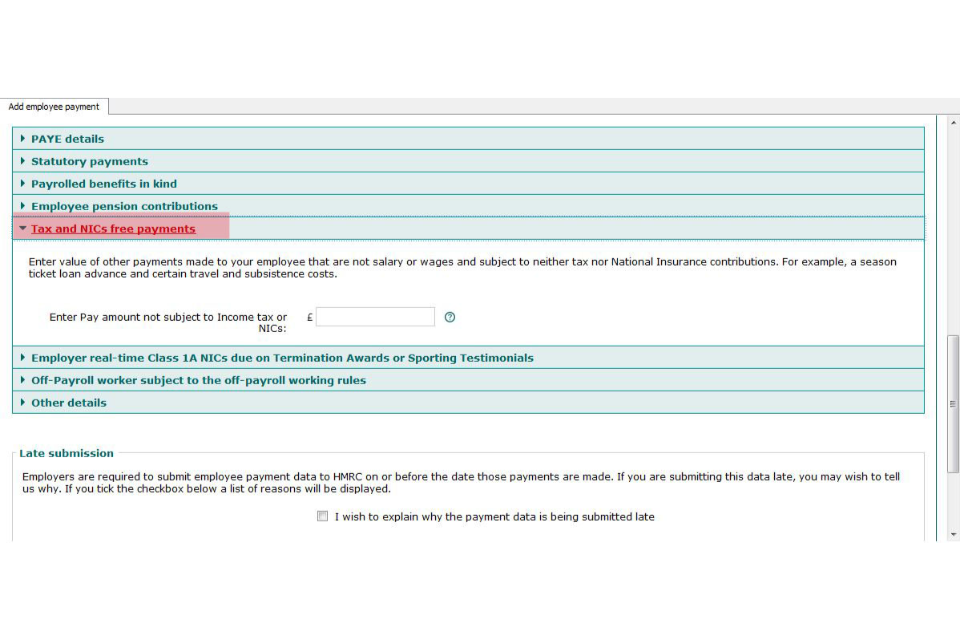

Basic Paye Tools User Guide Gov Uk

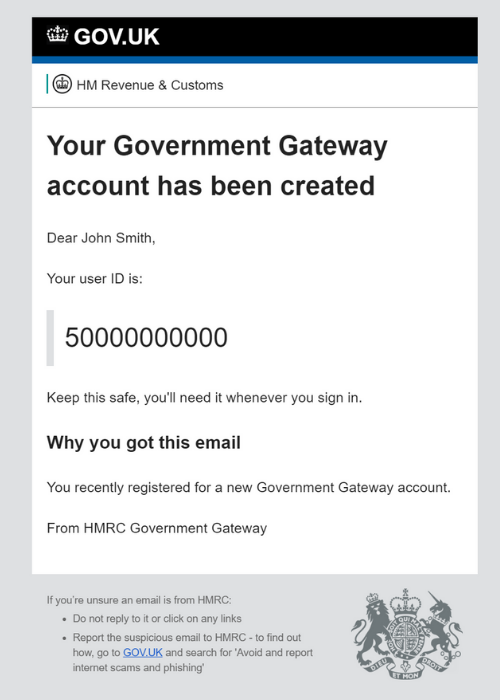

How Do I Find My Government Gateway User Id Taxscouts

![]()

Salary Calculator Michael Page

Uk Salary Tax Calculator 2021 2022 Calculate My Take Home Pay

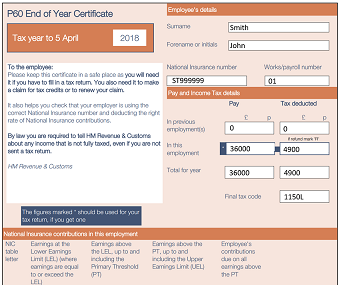

The P60 Form How To Get One For Your Self Assessment Tax Return Taxscouts

Basic Paye Tools User Guide Gov Uk

![]()

Ir35 Calculator Uk Tax Calculators

Comparison Of Uk And Usa Take Home The Salary Calculator

Net To Gross Salary Calculator Stafftax

Nanny Salary Pension Calculator Gross To Net Nannytax

Post a Comment for "Net Salary Calculator Uk Gov"