Does Gross Annual Income Include Capital Gains

Some or all net capital gain may be taxed at 0 if your taxable income is less than 80000. Economy does not include capital gains or losses in their National Income and Products Accounts NIPA from which GDP is calculated.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

One important exception exists.

Does gross annual income include capital gains. Theyre on line 13 of the 1040 which is in the income section and arent adjusted outexcluded from your taxable income but since they are taxed at a different rate make sure to follow the. When it comes to preparing your tax return this requires the use of a capital gains worksheet because even though you include capital gains. It also changes the treatment of capital gains and losses so that all capital gains and losses are included in gross income with a specific exception for like-kind exchanges of related-use property.

469050 for head of household or 248300 for married filing separately. 496600 for married filing jointly or qualifying widower. If you sell your primary residence you can exclude capital.

Youll first need to calculate your total income which includes wages from Form W-2 and self-employment income taxable interest and dividends alimony payments received capital gains rental income and any other payments you received that arent tax exempt. A capital gain rate of 15 applies if your taxable income is 80000 or more but less than 441450 for single. Your taxable income - which includes all your ordinary income your long term capital gains minus your standard or itemized deduction - dictates the top LTCG tax rate you will pay.

United-states capital-gain income adjusted-gross-income. Capital gains will increase your adjusted gross income AGI and this can cause you to lose eligibility to contribute to an IRA or a Roth IRA and you could be phased out of itemized deductions and some tax credits. The IRS stipulates that capital gains tax is applicable for taxpayers with modified adjusted gross income over certain thresholds.

After you take all available deductions from that sum including tax credits and write-offs youre left with your adjusted gross income. The Bureau of Economic Analysis BEA one of the principle statistics reporting agencies for the US. Depending on your situation that is how much of your taxable income income is ordinary vs.

So again long-term capital gains are taxed at different rates and separately from your ordinary income. Adjusted gross income AGI is your gross income which includes wages dividends alimony capital gains business income retirement distributions and other income. Capital gains are included in your income although they are taxed differently from your ordinary income.

This is not for tax compliance but does involve how income is reported on a tax return if the tax return was used to indicate gross income for a certain year. The capital gains tax is a tax on asset transformation and reorganization. Capital losses are limited to 3000 per year.

In calculating gross income you will not include the net capital gain if you have a capital loss carryover from the prior year. So capital gains included capital losses are not. How much is LTCG you can progress through the LTCG rates with some of the LTCG taxed at 0.

Capital gains count towards your income for determining tax bracket. The law now also provides that no carrybacks or carryovers of capital losses are allowed in computing gross investment income. Gross income means the total of your gross receipts reduced by cost of goods sold total capital and ordinary gains before subtracting any losses and all other income before subtracting any deductions.

Adjusted gross income is your total taxable income after adjustments.

Gross Income Definition How To Calculate Examples

:max_bytes(150000):strip_icc()/Howarecapitalgainsanddividendstaxeddifferently2-aa1e45473ab6480185b77281959dee5c.png)

How Are Capital Gains And Dividends Taxed Differently

Can Capital Gains Push Me Into A Higher Tax Bracket

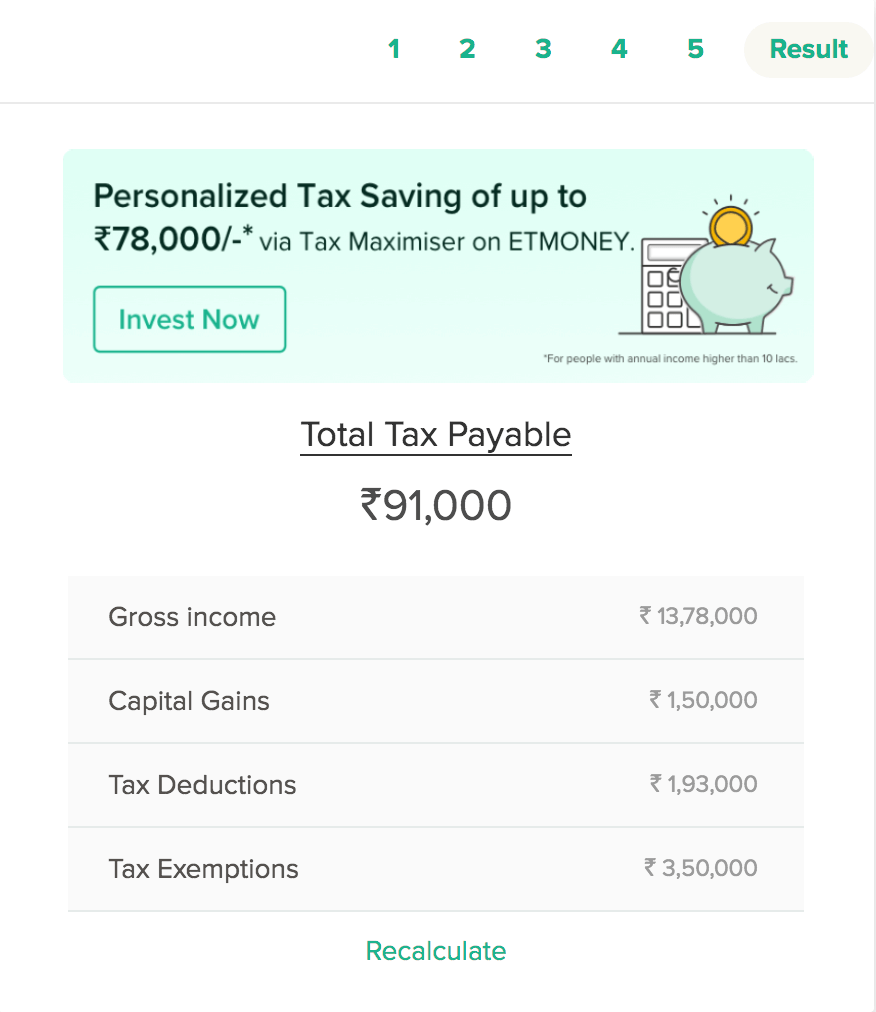

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

What You Need To Know About Capital Gains Tax

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Double Taxation Chart National Debt Capital Gains Tax Flow Chart

Tax Calculator Estimate Your Income Tax For 2020 And 2021 Free

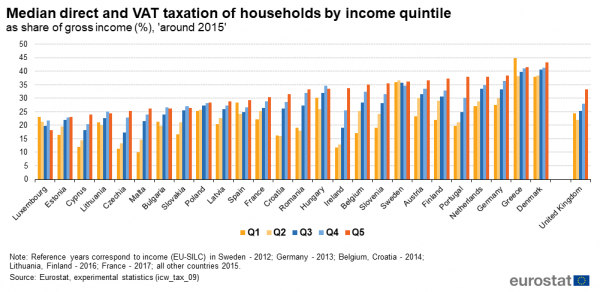

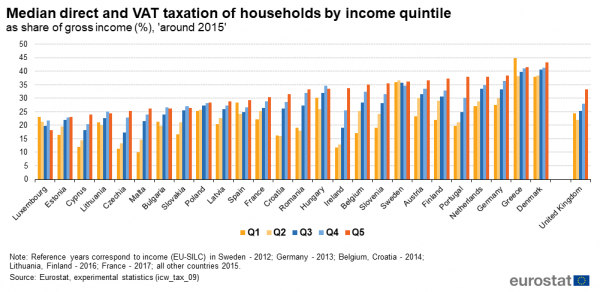

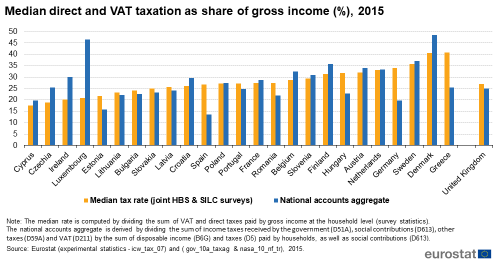

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

Taxable Income Calculator India Income Business Finance Investing

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/Howarecapitalgainsanddividendstaxeddifferently2-aa1e45473ab6480185b77281959dee5c.png)

How Are Capital Gains And Dividends Taxed Differently

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

How High Are Capital Gains Taxes In Your State Tax Foundation

What You Need To Know About Capital Gains Tax

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Post a Comment for "Does Gross Annual Income Include Capital Gains"