Salary Sacrifice Limits 2021

Salary sacrifice is not likely to affect your entitlement to the state pension unless your lowered salary is under the threshold to make National Insurance contributions. The GST-exclusive value of the car expenses is 10509.

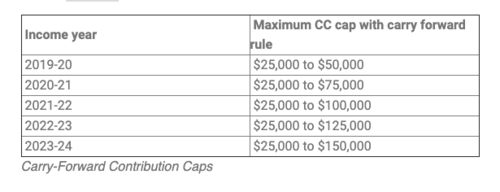

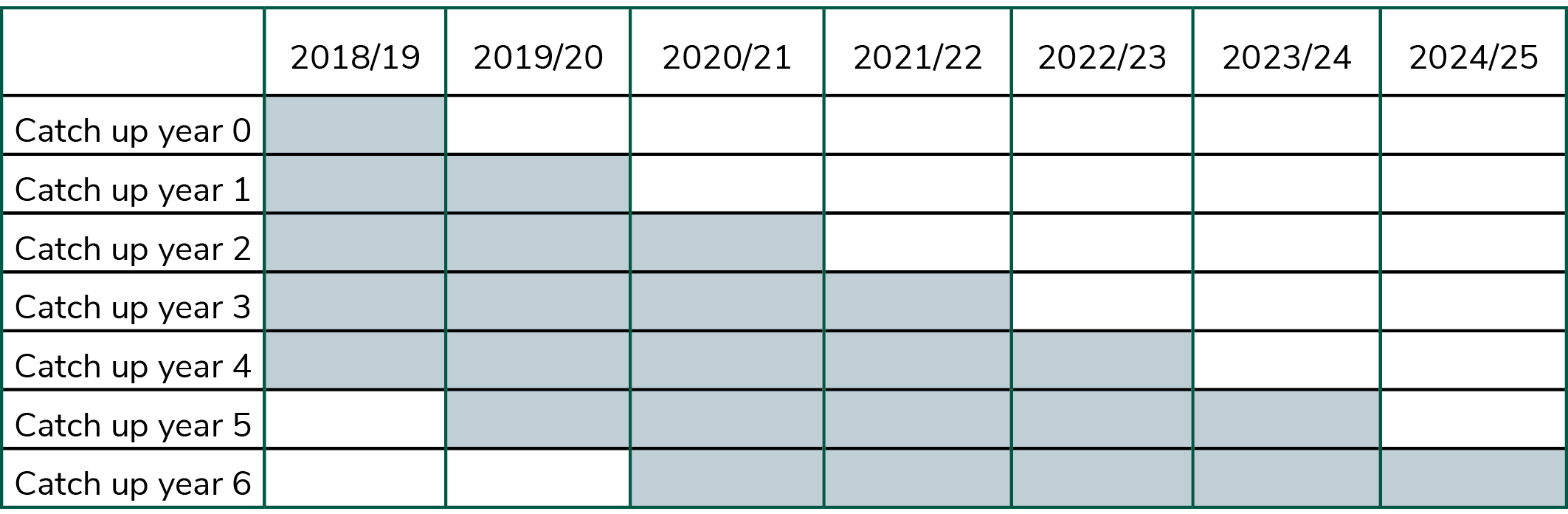

Indexation Of Super Contributions Caps Carrick Aland

In addition certain salary sacrifice schemes set up prior to 6 April 2017 have continued to be dealt with under the old rules unless varied or modified but will fall within the new rules from 6 April 2021.

Salary sacrifice limits 2021. You starting amount for the state pension may also include a deduction if you were in certain earning-related pension schemes before 6 April 2016 or had certain workplace personal or stakeholder pensions before 6 April 2012. Cars with CO2 emissions of more 75gkm. Assuming you have been in the 1995 pension scheme you can find this out from your TRS or annual benefit statement for 24 years this would equate to 2480th x 8253 2476 of pension growth.

Sam earns 65000 a year and is considering entering into an effective salary sacrifice arrangement. It is simple to follow and shows how you can benefit from doing this. Salary sacrifice lets you make contributions to your pension and helps to save on National Insurance at the same time.

And provides a breakdown of your annual salary. The table below provides an indication of the annual NIC savings available for the tax year 20212022 based on a pension salary sacrifice. This is not real pension growth but getting your old.

If for example the non-cash benefit is a pension contribution your employer would pay this along with a contribution they might make directly into your pension pot. Each salary sacrifice calculator allows you to enter salary sacrifice as a fixed amount of a percentage of your Gross pay. Salary sacrifice of a motor vehicle.

ICalculator Annual salary sacrifice calculator is updated for the 202122 tax year. It is calculated by using two methods as a salary sacrifice contribution or as an after-tax contribution. There are two ways in which you can do this simple salary sacrifice and SMART Save more and reduce tax.

Salary sacrifice limitations. Under this arrangement his employer will provide the use of a 35000 car and pay all the associated running expenses of 11500. Calculating your concessional contributions Salary sacrifice is considered as a concessional contribution.

The calculator should not be used if your Before-tax salary before any salary sacrifice contributions is greater than 235680 in the 202122 year. The salary sacrifice adjusted gross pay then provides a full tax calculation and includes personal tax allowances calculates your National Insurance Contributions and Your employers National Insurance Contributions deductions PAYE etc. Ensure you set up the salary sacrifice.

This has been updated for the current tax year of 202122. Salary Sacrifice Calculator Valid for the 2020-2021 Financial Year This assumes that you receive standard employer SG Contributions of 95 pa. Salary Sacrifice Calculator is the pre-tax contribution one make from the take home salary to the super account which later helps in the retirement.

If you earn more than 45000 per year salary sacrificing could benefit you. Unless there are limitations specified in the terms of your employment there is no limit to the amount you can salary sacrifice into super. The amount of National Insurance contributions NIC you could save will depend on your salary and the amount of pension salary sacrifice you choose.

However you should also consider whether the amount you wish to salary sacrifice. This measure is expected to impact individuals who are provided with BiKs under salary sacrifice or cash alternative arrangements. It is estimated that this will impact 1 million individuals.

The gross salary sacrifice in this example is 8253 when you give the car back your salary will go back up by 8253. Use the simple annual salary sacrifice calculator or switch to the advanced annual salary sacrifice calculator to review employers national insurance payments income tax deductions and PAYE tax commitments for 2021. You can calculate results based on either a fixed cash value or a certain proportion of your salary.

Salary sacrifice contributions are taxed at 15 when they are received by your superannuation fund unless you earn more than 250000 per year including super where your salary sacrificed contributions would be. This pre tax income helps to reduce the pay tax by reducing the taxable income. You can calculate your Annual take home pay based of your Annual gross income salary sacrifice adjustment PAYE NI and tax for 202122.

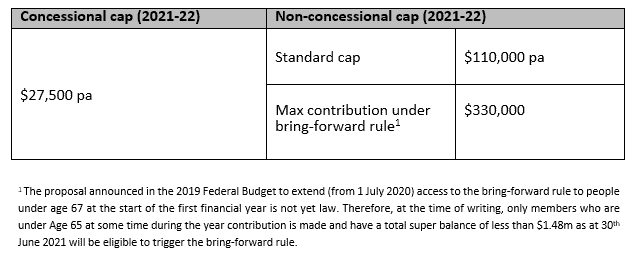

How to salary sacrifice into your super account. Concessional contribution limits 2021 - 2022 For the 2021 - 2022 financial year the concessional cap is 27500 for all individuals regardless of age. Talk to your employer and find out if they offer these arrangements as not every organisation does.

Salary sacrifice contributions are now added to your ordinary time earnings OTE so your employer must calculate their SG payments on the amount of your before-salary sacrifice income. However this calculator does not take into account the maximum contributions base. It is followed in United Kingdom and Australia.

The 11500 running expenses includes registration which is GST-free. Salary sacrifice means you can exchange part of your salary in return for a non-cash benefit from your employer.

Everything You Need To Know About Flexible Benefits In 2021

Pensions The Automatic Enrolment Earnings Trigger And Qualifying Earnings Band Order 2021 Payadvice Uk

Good News Super Contribution Caps To Rise Retire On Track

Key Superannuation Rates And Thresholds For 2021 22

Pin By Elite Shadows On My Saves In 2021 Great Quotes Positivity Quotes

Non Concessional Super Contributions Guide 2021 22

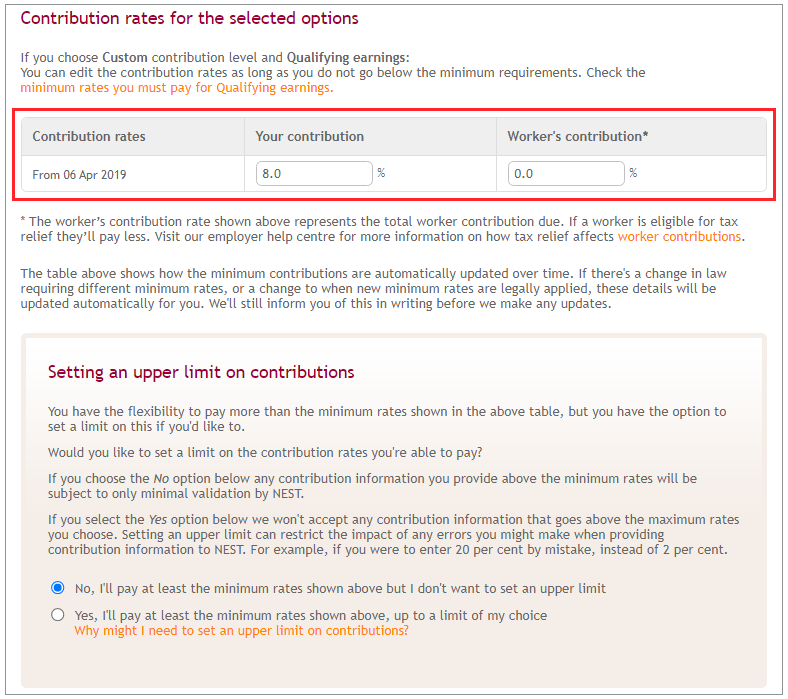

Salary Sacrifice Nest Pensions

2021 Superannuation Contributions Cap Update Schuh Group

New Super Contribution Caps For 2021 22 What Are The Implications Calibre Private Wealth

Admin Author At Cooper Partners

National Insurance Contribution Changes 2021 2022 Payadvice Uk

Update Indexation Of Contributions Caps Salt Financial Group

Voluntary Contributions Rei Super

Remuneration Everything Hr Professionals Need To Know

Https Www Ngssuper Com Au Files Documents Salary Sacrifice Pdf

New Super Contribution Caps For 2021 22 What Are The Implications Calibre Private Wealth

2021 Superannuation Contributions Cap Update Schuh Group

Open That Window In 2021 Hotel Humor Clean Funny Jokes Old Man Jokes

Post a Comment for "Salary Sacrifice Limits 2021"