Salary Sacrifice In Australia

In this video we look at what salary sacrificing in Australia is the pros and cons of salary sacrificing and examine the tax benefits. Salary sacrifice is an agreement between you and your employee that allows the employee to forego some part of their salary in exchange for other benefits.

.gif)

6302 0 Average Weekly Earnings Australia Nov 2012

Agrees to permanently forego part of their future entitlement to salary or wages receives benefits of a similar cost to the employer in return.

Salary sacrifice in australia. It is followed in United Kingdom and Australia. You can sacrifice a portion of your pre-tax income and divert that money towards other causes such as rent car payments or superannuation. Salary sacrifice is an arrangement whereby your employer pays for goods or services on your behalf out of your pre-tax salary.

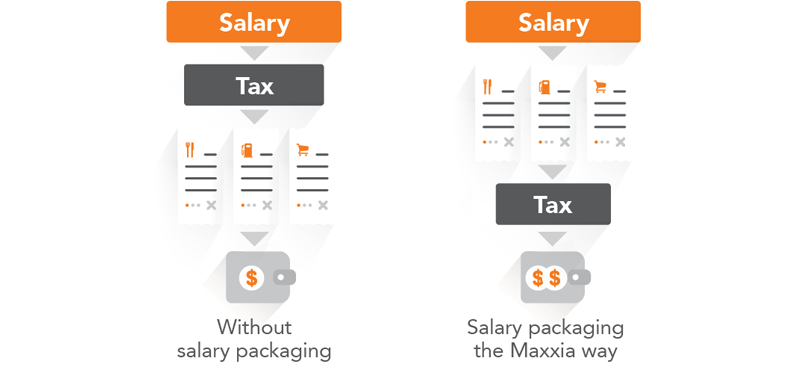

This can reduce your taxable income and increase your disposable income each pay period. Salary Sacrifice Calculator is the pre-tax contribution one make from the take home salary to the super account which later helps in the retirement. From 1 July 2019 you can carry forward any unused portion of the concessional contributions cap for up to five previous financial years depending on your super.

Under a salary sacrifice arrangement you agree to forego a portion of your gross salary in return for non-cash benefits of a similar value. It is calculated by using two methods as a salary sacrifice contribution or as an after-tax contribution. The primary benefit used in salary sacrifice is the superannuation fund or super which is Australias pension program.

The current concessional contribution cap is 25000 per financial year. Annonce Payroll Employment Law for 140 Countries. Salary sacrifice is an arrangement with your employer to forego part of your salary or wages in return for your employer providing benefits of a similar value.

It is an arrangement between an employer and an employee where the employee. Salary sacrifice contributions are included in the concessional before-tax contributions cap along with the super contributions your employer makes for you and after-tax contributions you claim a tax deduction for. Any employee can salary sacrifice provided their.

Salary sacrificing enables you to pay for a range of living expenses with your pre-tax salary. Salary sacrificing is sometimes called salary packaging or total remuneration packaging. These benefits are paid out of your pre-tax salary.

A salary sacrifice arrangement is when you agree to receive less take-home income from your employer in return for benefits. The employer may be liable to pay fringe benefits tax FBT on the benefits provided in lieu of salary. The employee pays income tax on the reduced salary or wages.

Under an effective salary sacrifice arrangement. Salary sacrificing is a part of salary packaging here in Australia in which employees ie. Make sure you are locally compliant with Papaya Global help.

Salary Sacrifice Australia - tips traps benefits. A salary sacrifice arrangement is also referred to as salary packaging or total remuneration packaging. However this calculator does not take into account the maximum contributions base.

Depending on your salary the financial benefits from salary packaging can be significant. Ato Go to atogovau. Benefits can include goods and services like a car or laptop or contributions to your superannuation account.

As a result you only pay tax on your reduced salary but you physically receive the reduced salary plus the benefits. This cap is currently 27500 pa. While we specalise in salary sacrificing cars Australia-wide salary sacrificing can also be used to reduce your taxable income on a number of other expenses like insurance loan repayments and other personal expenses it just comes down to your employer.

Salary Sacrifice Australia - tips traps benefits - YouTube. If playback doesnt. As mentioned above salary sacrifice contributions count towards the concessional contribution cap.

Salary sacrifice or salary packaging is an Australian Tax Office ATO approved method of increasing your take-home pay by lowering your taxable income. Superannuation guarantee contributions are payable on salary or wages up to the maximum contributions base which is 58920 per quarter for the 202122 year. Global salary benchmark and benefit data.

This pre tax income helps to reduce the pay tax by reducing the taxable income.

Salary Sacrifice Arrangements Brentnalls Sa Accountants Advisory Services

Salary Sacrificing Voluntary Superannuation Contribution Vsc Pdf Free Download

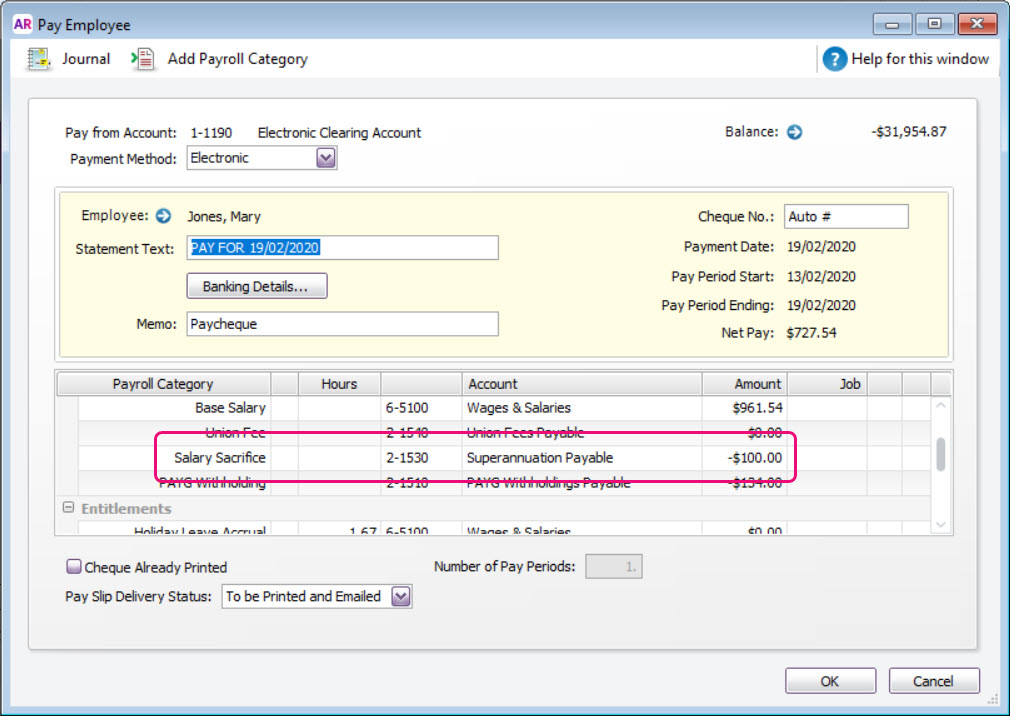

Set Up Salary Sacrifice Superannuation Myob Accountright Myob Help Centre

Fillable Online Australia Salary Sacrifice Superannuation Election Form Fax Email Print Pdffiller

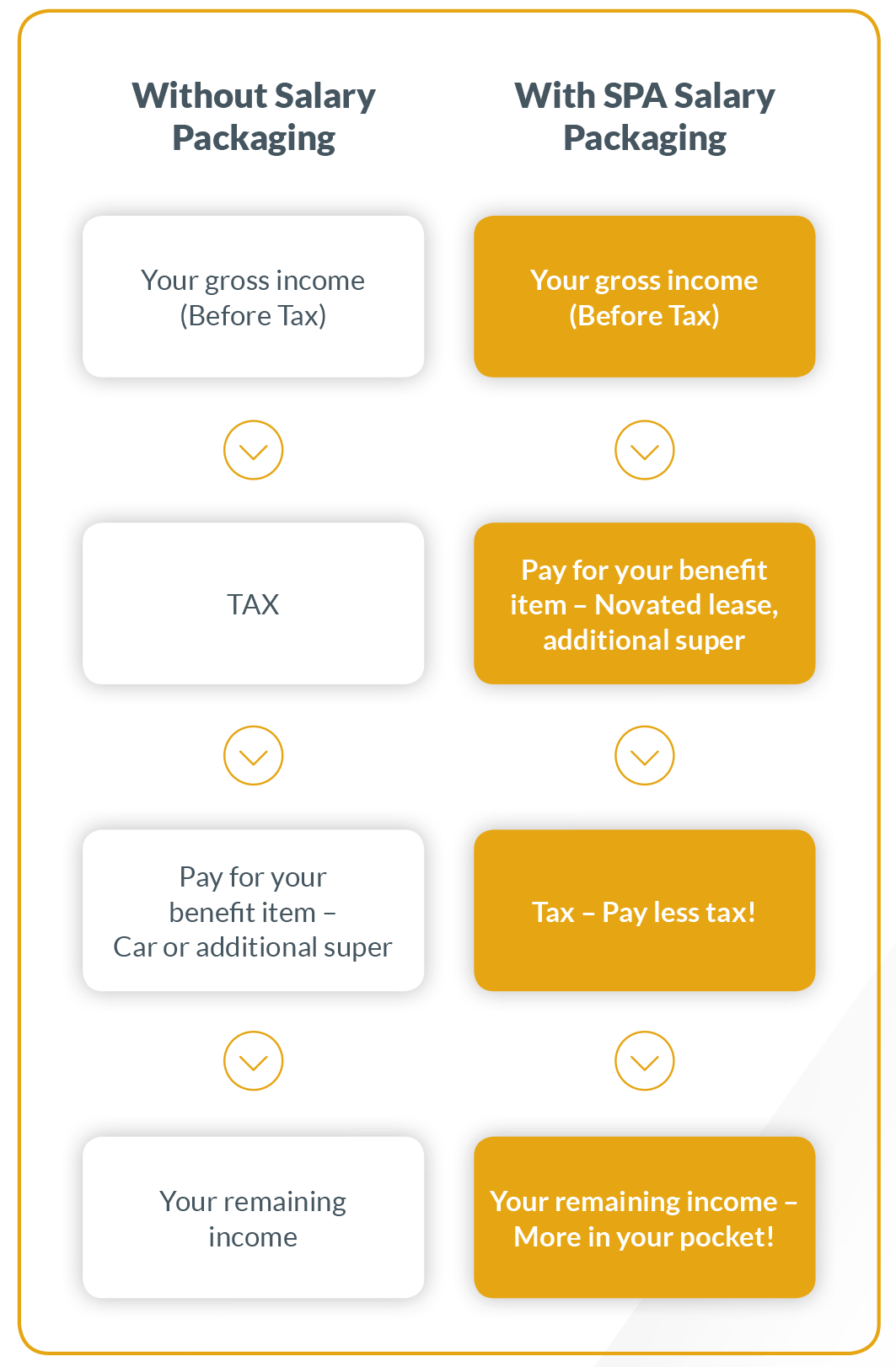

What Is Salary Packaging Salary Packaging Australia

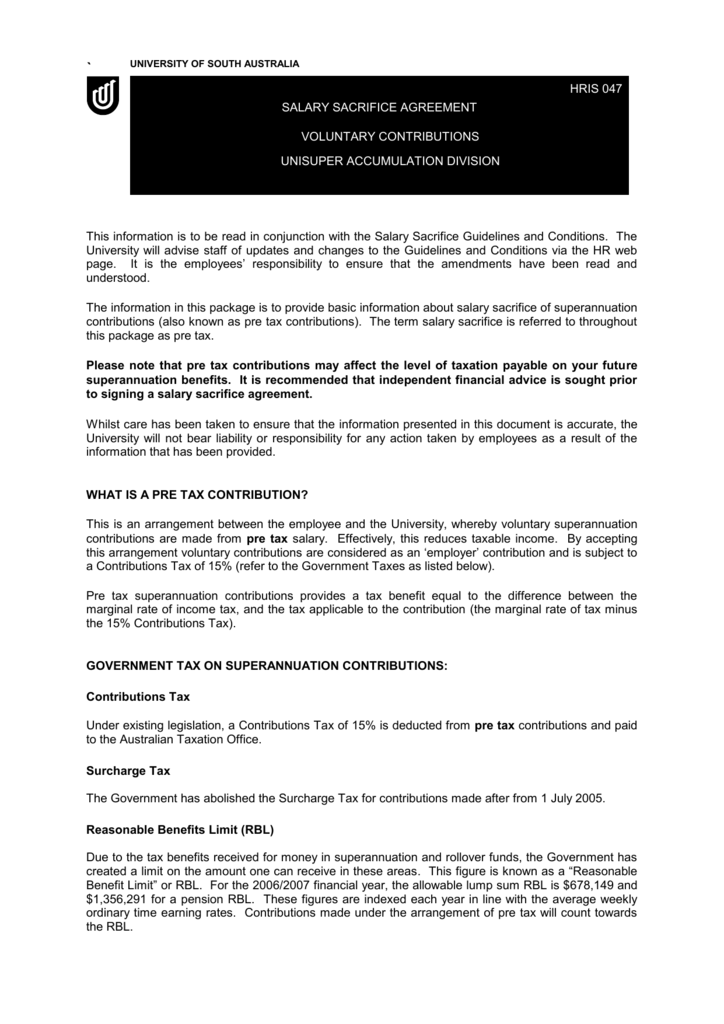

Salary Sacrifice Agreement University Of South Australia

Salary Packaging Eastern Health

Motor Vehicle Salary Packaging How Much Can You Save

Salary Sacrifice Letter Template Request To Make Salary Deductions

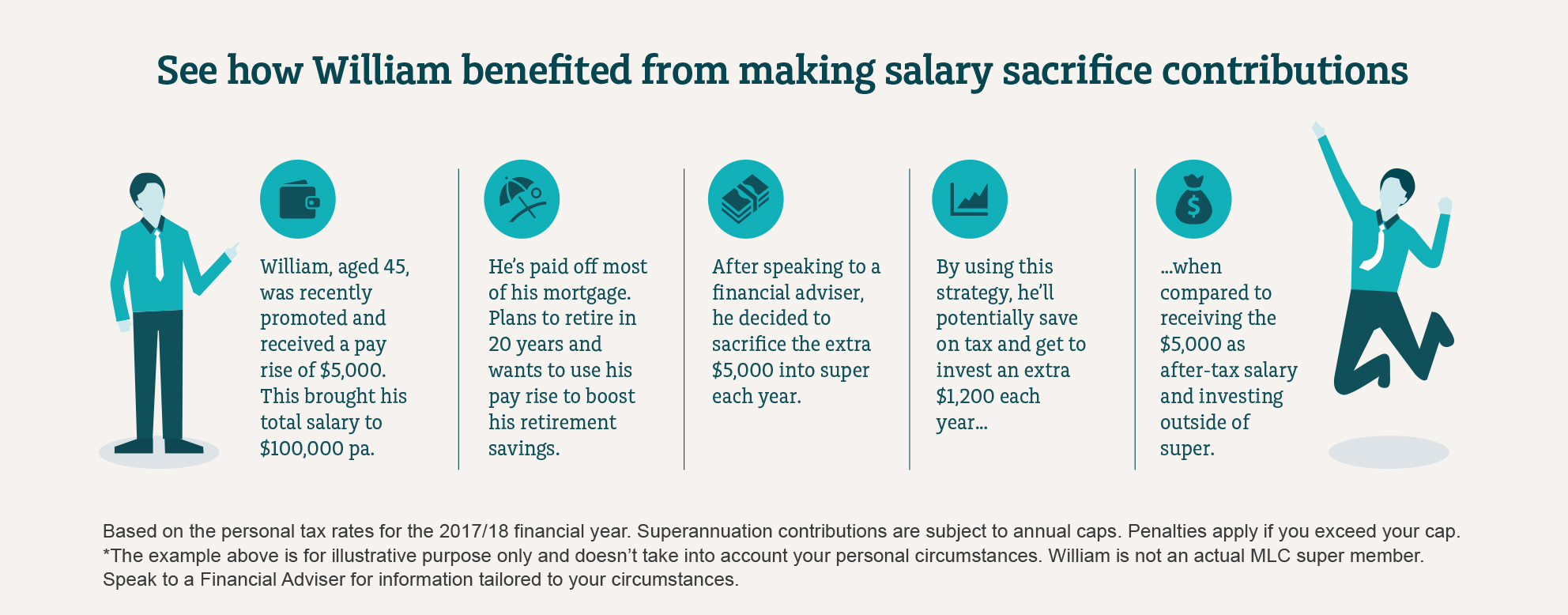

Salary Sacrifice Boost Your Super Mlc

What Is Salary Sacrifice And Is It Still Relevant Practical Systems Super

Content Mercer Super Trust Australia

Salary Sacrifice Australian Customs Service

Salary Sacrificing To Super Mc Ewen Investment

Salary Sacrifice Form Template Fill Online Printable Fillable Blank Pdffiller

Post a Comment for "Salary Sacrifice In Australia"